Page 274 - CA Final GST

P. 274

Badlani Classes

Chapter : 28

E-Way Bill

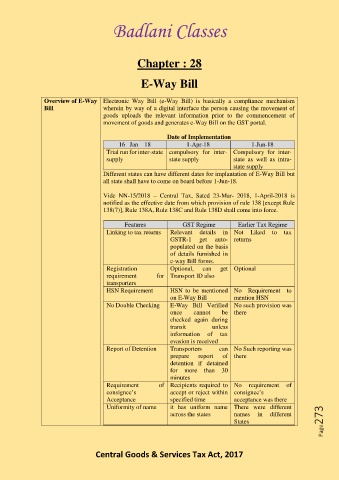

Overview of E-Way Electronic Way Bill (e-Way Bill) is basically a compliance mechanism

Bill wherein by way of a digital interface the person causing the movement of

goods uploads the relevant information prior to the commencement of

movement of goods and generates e-Way Bill on the GST portal.

Date of Implementation

16 –Jan – 18 1-Apr-18 1-Jun-18

Trial run for inter-state compulsory for inter- Compulsory for inter-

supply state supply state as well as intra-

state supply

Different states can have different dates for implantation of E-Way Bill but

all state shall have to come on board before 1-Jun-18.

Vide NN-15/2018 – Central Tax, Sated 23-Mar- 2018, 1-April-2018 is

notified as the effective date from which provision of rule 138 [except Rule

138(7)], Rule 138A, Rule 138C and Rule 138D shall come into force.

Features GST Regime Earlier Tax Regime

Linking to tax returns Relevant details in Not Liked to tax

GSTR-1 get auto- returns

populated on the basis

of details furnished in

e-way Bill forms.

Registration Optional, can get Optional

requirement for Transport ID also

transporters

HSN Requirement HSN to be mentioned No Requirement to

on E-Way Bill mention HSN

No Double Checking E-Way Bill Verified No such provision was

once cannot be there

checked again during

transit unless

information of tax

evasion is received

Report of Detention Transporters can No Such reporting was

prepare report of there

detention if detained

for more than 30

minutes

Requirement of Recipients required to No requirement of

consignee’s accept or reject within consignee’s

Acceptance specified time acceptance was there

Uniformity of name it has uniform name There were different

across the states names in different

States Page273

Central Goods & Services Tax Act, 2017