Page 275 - CA Final GST

P. 275

Badlani Classes

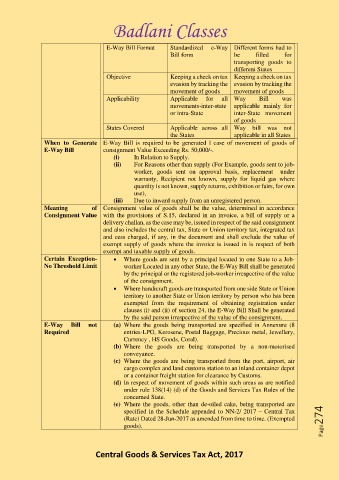

E-Way Bill Format Standardized e-Way Different forms had to

Bill form be filled for

transporting goods to

different States

Objective Keeping a check on tax Keeping a check on tax

evasion by tracking the evasion by tracking the

movement of goods movement of goods

Applicability Applicable for all Way Bill was

movements-inter-state applicable mainly for

or intra-State inter-State movement

of goods

States Covered Applicable across all Way bill was not

the States applicable in all States

When to Generate E-Way Bill is required to be generated I case of movement of goods of

E-Way Bill consignment Value Exceeding Rs. 50,000/-.

(i) In Relation to Supply.

(ii) For Reasons other than supply (For Example, goods sent to job-

worker, goods sent on approval basis, replacement under

warranty, Recipient not known, supply for liquid gas where

quantity is not known, supply returns, exhibition or fairs, for own

use),

(iii) Due to inward supply from an unregistered person.

Meaning of Consignment value of goods shall be the value, determined in accordance

Consignment Value with the provisions of S.15, declared in an invoice, a bill of supply or a

delivery challan, as the case may be, issued in respect of the said consignment

and also includes the central tax, State or Union territory tax, integrated tax

and cess charged, if any, in the document and shall exclude the value of

exempt supply of goods where the invoice is issued in is respect of both

exempt and taxable supply of goods.

Certain Exception- • Where goods are sent by a principal located in one State to a Job-

No Threshold Limit worker Located in any other State, the E-Way Bill shall be generated

by the principal or the registered job-worker irrespective of the value

of the consignment.

• Where handicraft goods are transported from one side State or Union

territory to another State or Union territory by person who has been

exempted from the requirement of obtaining registration under

clauses (i) and (ii) of section 24, the E-Way Bill Shall be generated

by the said person irrespective of the value of the consignment.

E-Way Bill not (a) Where the goods being transported are specified in Annexure (8

Required entries-LPG, Kerosene, Postal Baggage, Precious metal, Jewellery,

Currency , HS Goods, Coral).

(b) Where the goods are being transported by a non-motorised

conveyance.

(c) Where the goods are being transported from the port, airport, air

cargo complex and land customs station to an inland container depot

or a container freight station for clearance by Customs.

(d) In respect of movement of goods within such areas as are notified

under rule 138(14) (d) of the Goods and Services Tax Rules of the

concerned State.

(e) Where the goods, other than de-oiled cake, being transported are

specified in the Schedule appended to NN-2/ 2017 – Central Tax

(Rate) Dated 28-Jun-2017 as amended from time to time. (Exempted Page274

goods).

Central Goods & Services Tax Act, 2017