Page 277 - CA Final GST

P. 277

Badlani Classes

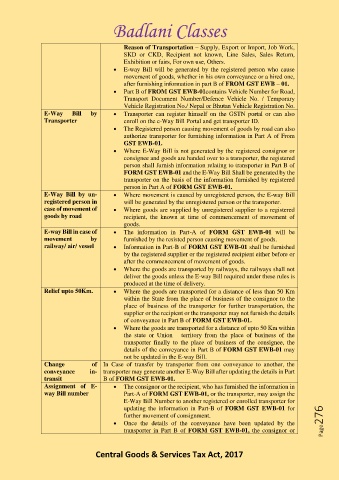

Reason of Transportation – Supply, Export or Import, Job Work,

SKD or CKD, Recipient not known, Line Sales, Sales Return,

Exhibition or fairs, For own use, Others.

• E-way Bill will be generated by the registered person who cause

movement of goods, whether in his own conveyance or a hired one,

after furnishing information in part B of FROM GST EWB – 01.

• Part B of FROM GST EWB-01contains Vehicle Number for Road,

Transport Document Number/Defence Vehicle No. / Temporary

Vehicle Registration No./ Nepal or Bhutan Vehicle Registration No.

E-Way Bill by • Transporter can register himself on the GSTN portal or can also

Transporter enroll on the e-Way Bill Portal and get transporter ID.

• The Registered person causing movement of goods by road can also

authorize transporter for furnishing information in Part A of From

GST EWB-01.

• Where E-Way Bill is not generated by the registered consignor or

consignee and goods are handed over to a transporter, the registered

person shall furnish information relating to transporter in Part B of

FORM GST EWB-01 and the E-Way Bill Shall be generated by the

transporter on the basis of the information furnished by registered

person in Part A of FORM GST EWB-01.

E-Way Bill by un- • Where movement is caused by unregistered person, the E-way Bill

registered person in will be generated by the unregistered person or the transporter.

case of movement of • Where goods are supplied by unregistered supplier to a registered

goods by road recipient, the known at time of commencement of movement of

goods.

E-way Bill in case of • The information in Part-A of FORM GST EWB-01 will be

movement by furnished by the resisted person causing movement of goods.

railway/ air/ vessel • Information in Part-B of FORM GST EWB-01 shall be furnished

by the registered supplier or the registered recipient either before or

after the commencement of movement of goods.

• Where the goods are transported by railways, the railways shall not

deliver the goods unless the E-way Bill required under these rules is

produced at the time of delivery.

Relief upto 50Km. • Where the goods are transported for a distance of less than 50 Km

within the State from the place of business of the consignor to the

place of business of the transporter for further transportation, the

supplier or the recipient or the transporter may not furnish the details

of conveyance in Part B of FORM GST EWB-01.

• Where the goods are transported for a distance of upto 50 Km within

the state or Union territory from the place of business of the

transporter finally to the place of business of the consignee, the

details of the conveyance in Part B of FORM GST EWB-01 may

not be updated in the E-way Bill.

Change of In Case of transfer by transporter from one conveyance to another, the

conveyance in- transporter may generate another E-Way Bill after updating the details in Part

transit B of FORM GST EWB-01.

Assignment of E- • The consignor or the recipient, who has furnished the information in

way Bill number Part-A of FORM GST EWB-01, or the transporter, may assign the

E-Way Bill Number to another registered or enrolled transporter for

updating the information in Part-B of FORM GST EWB-01 for

further movement of consignment.

• Once the details of the conveyance have been updated by the Page276

transporter in Part B of FORM GST EWB-01, the consignor or

Central Goods & Services Tax Act, 2017