Page 282 - CA Final GST

P. 282

Badlani Classes

Chapter XVIII [Sections 107 to 121] of the CGST Act supplemented with Chapter XIII

[Rule 108 to 116] of the CGST Rules prescribe the provisions relating to appeals and

revision. State GST laws also prescribed identical provision relating to appeals.

2- What do you mean by: (i) Appellate Authority ;(ii) Appellate Tribunal; (iii)

Authorized representative.

The relevant definitions are as under-

1- “Appellate Authority” means an authority appointed or authorized to hear appeals as referred to in

section 107 [Section 2(8) ]

2- “Appellate Tribunal” means the Goods and Services Tax Appellate Tribunal constituted under

Section 109. [ Section 2(9)]

3- “Authorized representative” means the representative as referred to in Section 116. [Section 2(15)]

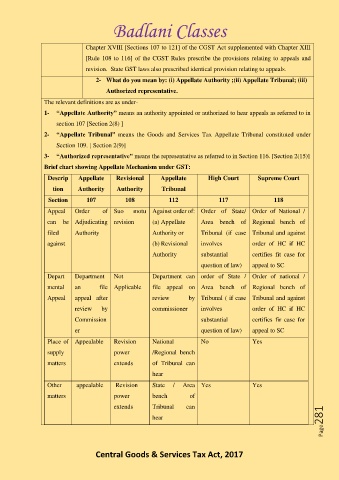

Brief chart showing Appellate Mechanism under GST:

Descrip Appellate Revisional Appellate High Court Supreme Court

tion Authority Authority Tribunal

Section 107 108 112 117 118

Appeal Order of Suo motu Against order of: Order of State/ Order of National /

can be Adjudicating revision (a) Appellate Area bench of Regional bench of

filed Authority Authority or Tribunal (if case Tribunal and against

against (b) Revisional involves order of HC if HC

Authority substantial certifies fit case for

question of law) appeal to SC

Depart Department Not Department can order of State / Order of national /

mental an file Applicable file appeal on Area bench of Regional bench of

Appeal appeal after review by Tribunal ( if case Tribunal and against

review by commissioner involves order of HC if HC

Commission substantial certifies fir case for

er question of law) appeal to SC

Place of Appealable Revision National No Yes

supply power /Regional bench

matters extends of Tribunal can

hear

Other appealable Revision State / Area Yes Yes

matters power bench of

Page281

extends Tribunal can

hear

Central Goods & Services Tax Act, 2017