Page 286 - CA Final GST

P. 286

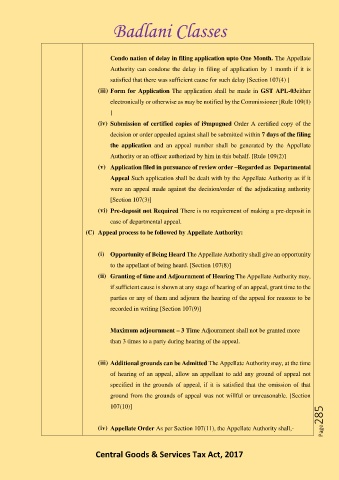

Badlani Classes

Condo nation of delay in filing application upto One Month. The Appellate

Authority can condone the delay in filing of application by 1 month if it is

satisfied that there was sufficient cause for such delay [Section 107(4) ]

(iii) Form for Application The application shall be made in GST APL-03either

electronically or otherwise as may be notified by the Commissioner [Rule 109(1)

]

(iv) Submission of certified copies of i9mpugned Order A certified copy of the

decision or order appealed against shall be submitted within 7 days of the filing

the application and an appeal number shall be generated by the Appellate

Authority or an officer authorized by him in this behalf. [Rule 109(2)]

(v) Application filed in pursuance of review order –Regarded as Departmental

Appeal Such application shall be dealt with by the Appellate Authority as if it

were an appeal made against the decision/order of the adjudicating authority

[Section 107(3)]

(vi) Pre-deposit not Required There is no requirement of making a pre-deposit in

case of departmental appeal.

(C) Appeal process to be followed by Appellate Authority:

(i) Opportunity of Being Heard The Appellate Authority shall give an opportunity

to the appellant of being heard. [Section 107(8)]

(ii) Granting of time and Adjournment of Hearing The Appellate Authority may,

if sufficient cause is shown at any stage of hearing of an appeal, grant time to the

parties or any of them and adjourn the hearing of the appeal for reasons to be

recorded in writing [Section 107(9)]

Maximum adjournment – 3 Time Adjournment shall not be granted more

than 3 times to a party during hearing of the appeal.

(iii) Additional grounds can be Admitted The Appellate Authority may, at the time

of hearing of an appeal, allow an appellant to add any ground of appeal not

specified in the grounds of appeal, if it is satisfied that the omission of that

ground from the grounds of appeal was not willful or unreasonable. [Section

Page285

107(10)]

(iv) Appellate Order As per Section 107(11), the Appellate Authority shall,-

Central Goods & Services Tax Act, 2017