Page 288 - CA Final GST

P. 288

Badlani Classes

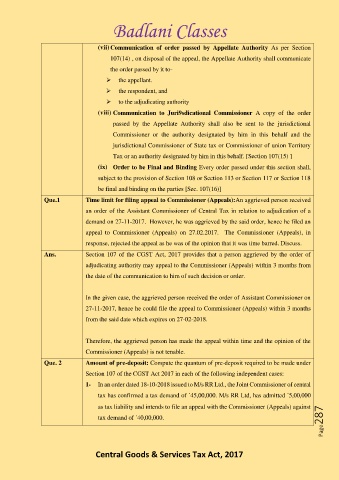

(vii) Communication of order passed by Appellate Authority As per Section

107(14) , on disposal of the appeal, the Appellate Authority shall communicate

the order passed by it to-

➢ the appellant.

➢ the respondent, and

➢ to the adjudicating authority

(viii) Communication to Juri9sdicational Commissioner A copy of the order

passed by the Appellate Authority shall also be sent to the jurisdictional

Commissioner or the authority designated by him in this behalf and the

jurisdictional Commissioner of State tax or Commissioner of union Territory

Tax or an authority designated by him in this behalf. [Section 107(15) ]

(ix) Order to be Final and Binding Every order passed under this section shall,

subject to the provision of Section 108 or Section 113 or Section 117 or Section 118

be final and binding on the parties [Sec. 107(16)]

Que.1 Time limit for filing appeal to Commissioner (Appeals):An aggrieved person received

an order of the Assistant Commissioner of Central Tax in relation to adjudication of a

demand on 27-11-2017. However, he was aggrieved by the said order, hence he filed an

appeal to Commissioner (Appeals) on 27.02.2017. The Commissioner (Appeals), in

response, rejected the appeal as he was of the opinion that it was time barred. Discuss.

Ans. Section 107 of the CGST Act, 2017 provides that a person aggrieved by the order of

adjudicating authority may appeal to the Commissioner (Appeals) within 3 months from

the date of the communication to him of such decision or order.

In the given case, the aggrieved person received the order of Assistant Commissioner on

27-11-2017, hence he could file the appeal to Commissioner (Appeals) within 3 months

from the said date which expires on 27-02-2018.

Therefore, the aggrieved person has made the appeal within time and the opinion of the

Commissioner (Appeals) is not tenable.

Que. 2 Amount of pre-deposit: Compute the quantum of pre-deposit required to be made under

Section 107 of the CGST Act 2017 in each of the following independent cases:

1- In an order dated 18-10-2018 issued to M/s RR Ltd., the Joint Commissioner of central

tax has confirmed a tax demand of `45,00,000. M/s RR Ltd, has admitted `5,00,000

Page287

as tax liability and intends to file an appeal with the Commissioner (Appeals) against

tax demand of `40,00,000.

Central Goods & Services Tax Act, 2017