Page 283 - CA Final GST

P. 283

Badlani Classes

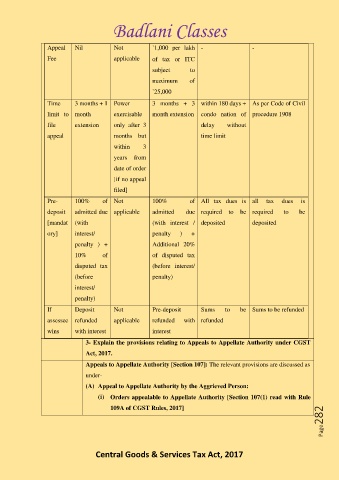

Appeal Nil Not `1,000 per lakh - -

Fee applicable of tax or ITC

subject to

maximum of

`25,000

Time 3 months + 1 Power 3 months + 3 within 180 days + As per Code of Civil

limit to month exercisable month extension condo nation of procedure 1908

file extension only after 3 delay without

appeal months but time limit

within 3

years from

date of order

[if no appeal

filed]

Pre- 100% of Not 100% of All tax dues is all tax dues is

deposit admitted due applicable admitted due required to be required to be

[mandat (with (with interest / deposited deposited

ory] interest/ penalty ) +

penalty ) + Additional 20%

10% of of disputed tax

disputed tax (before interest/

(before penalty)

interest/

penalty)

If Deposit Not Pre-deposit Sums to be Sums to be refunded

assessee refunded applicable refunded with refunded

wins with interest interest

3- Explain the provisions relating to Appeals to Appellate Authority under CGST

Act, 2017.

Appeals to Appellate Authority [Section 107]: The relevant provisions are discussed as

under-

(A) Appeal to Appellate Authority by the Aggrieved Person:

(i) Orders appealable to Appellate Authority [Section 107(1) read with Rule

Page282

109A of CGST Rules, 2017]

Central Goods & Services Tax Act, 2017