Page 279 - CA Final GST

P. 279

Badlani Classes

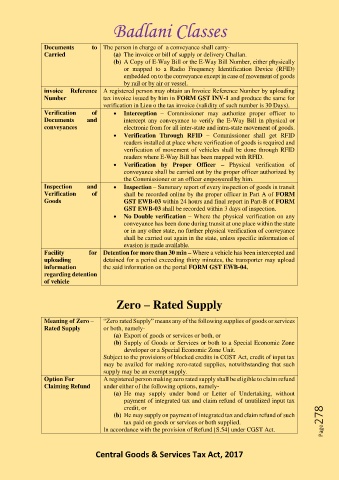

Documents to The person in charge of a conveyance shall carry-

Carried (a) The invoice or bill of supply or delivery Challan.

(b) A Copy of E-Way Bill or the E-Way Bill Number, either physically

or mapped to a Radio Frequency Identification Device (RFID)

embedded on to the conveyance except in case of movement of goods

by rail or by air or vessel.

invoice Reference A registered person may obtain an Invoice Reference Number by uploading

Number tax invoice issued by him in FORM GST INV-1 and produce the same for

verification in Lieu o the tax invoice (validity of such number is 30 Days).

Verification of • Interception – Commissioner may authorize proper officer to

Documents and intercept any conveyance to verify the E-Way Bill in physical or

conveyances electronic from for all inter-state and intra-state movement of goods.

• Verification Through RFID – Commissioner shall get RFID

readers installed at place where verification of goods is required and

verification of movement of vehicles shall be done through RFID

readers where E-Way Bill has been mapped with RFID.

• Verification by Proper Officer – Physical verification of

conveyance shall be carried out by the proper officer authorized by

the Commissioner or an officer empowered by him.

Inspection and • Inspection – Summary report of every inspection of goods in transit

Verification of shall be recorded online by the proper officer in Part A of FORM

Goods GST EWB-03 within 24 hours and final report in Part-B of FORM

GST EWB-03 shall be recorded within 3 days of inspection.

• No Double verification – Where the physical verification on any

conveyance has been done during transit at one place within the state

or in any other state, no further physical verification of conveyance

shall be carried out again in the state, unless specific information of

evasion is made available.

Facility for Detention for more than 30 min – Where a vehicle has been intercepted and

uploading detained for a period exceeding thirty minutes, the transporter may upload

information the said information on the portal FORM GST EWB-04.

regarding detention

of vehicle

Zero – Rated Supply

Meaning of Zero – “Zero rated Supply” means any of the following supplies of goods or services

Rated Supply or both, namely-

(a) Export of goods or services or both, or

(b) Supply of Goods or Services or both to a Special Economic Zone

developer or a Special Economic Zone Unit.

Subject to the provisions of blocked credits in CGST Act, credit of input tax

may be availed for making zero-rated supplies, notwithstanding that such

supply may be an exempt supply.

Option For A registered person making zero rated supply shall be eligible to claim refund

Claiming Refund under either of the following options, namely-

(a) He may supply under bond or Letter of Undertaking, without

payment of integrated tax and claim refund of unutilized input tax

credit, or

(b) He may supply on payment of integrated tax and claim refund of such

tax paid on goods or services or both supplied. Page278

In accordance with the provision of Refund [S.54] under CGST Act.

Central Goods & Services Tax Act, 2017