Page 285 - CA Final GST

P. 285

Badlani Classes

(iv) Admitted tax and 10% of disputed tax to be deposited before Filling Appeal

No appeal shall be filed under Section 107(1), unless the appellant has paid-

(a) in full, such part of the amount of tax, interest, fine fee and penalty arising

from the impugned order, as is admitted by him; and

(b) a sum equal to 10% of the remaining amount of tax in dispute arising from

the said order, in relation to which the appeal has been filed. [Section 107(6)

]

On pre-deposit of tax-recovery Proceedings to be Stayed Where the appellant

has paid the amount under Section 107(6), the recovery proceedings for the

balance amount shall be deemed to be stayed. [Section 107(7)]

(B) Application before Appellate Authority by the Department:

(i) Orders against which the review application can be filed by Commissioner

before the Appellate Authority [Section 107(2) read with Rule 109A of

CGST Rules, 2017][Inserted w.e.f.15-11-2017]: The Commissioner may on his

own motion, or upon request from the SGST/UTGST Commissioner, call for and

examine the record of any proceedings in which an adjudicating authority has

passed any decision or order under CGST Act or the SGST Act or the UTGST

Act, for the purpose of satisfying himself as to the legality or propriety of the

said decision or order; and may, by order direct any officer subordinate to him,

to apply to the Appellate Authority as under:

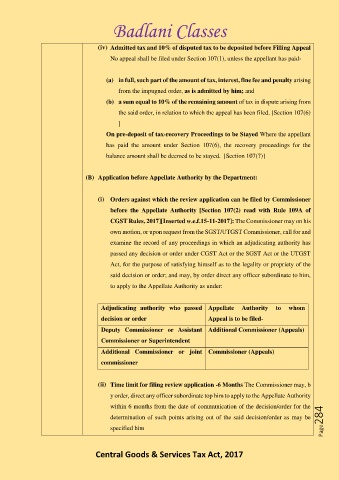

Adjudicating authority who passed Appellate Authority to whom

decision or order Appeal is to be filed-

Deputy Commissioner or Assistant Additional Commissioner (Appeals)

Commissioner or Superintendent

Additional Commissioner or joint Commissioner (Appeals)

commissioner

(ii) Time limit for filing review application -6 Months The Commissioner may, b

y order, direct any officer subordinate top him to apply to the Appellate Authority

within 6 months from the date of communication of the decision/order for the

determination of such points arising out of the said decision/order as may be Page284

specified him

Central Goods & Services Tax Act, 2017