Page 103 - FlipBook BACK FROM SARAN - MAY 5 2020 - Don't Make Me Say I Told You So_6.14x9.21_v9_Neat

P. 103

Don’t Make Me Say I Told You So 89

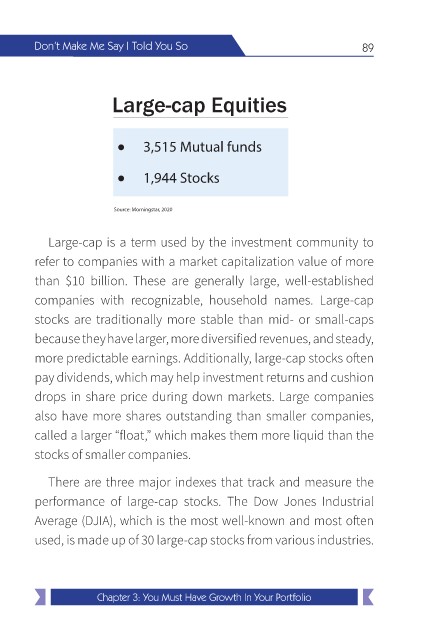

Large-cap Equities

3,515 Mutual funds

1,944 Stocks

Source: Morningstar, 2020

Large-cap is a term used by the investment community to

refer to companies with a market capitalization value of more

than $10 billion. These are generally large, well-established

companies with recognizable, household names. Large-cap

stocks are traditionally more stable than mid- or small-caps

because they have larger, more diversified revenues, and steady,

more predictable earnings. Additionally, large-cap stocks often

pay dividends, which may help investment returns and cushion

drops in share price during down markets. Large companies

also have more shares outstanding than smaller companies,

called a larger “float,” which makes them more liquid than the

stocks of smaller companies.

There are three major indexes that track and measure the

performance of large-cap stocks. The Dow Jones Industrial

Average (DJIA), which is the most well-known and most often

used, is made up of 30 large-cap stocks from various industries.

Chapter 3: You Must Have Growth In Your Portfolio