Page 100 - FlipBook BACK FROM SARAN - MAY 5 2020 - Don't Make Me Say I Told You So_6.14x9.21_v9_Neat

P. 100

86 Don’t Make Me Say I Told You So

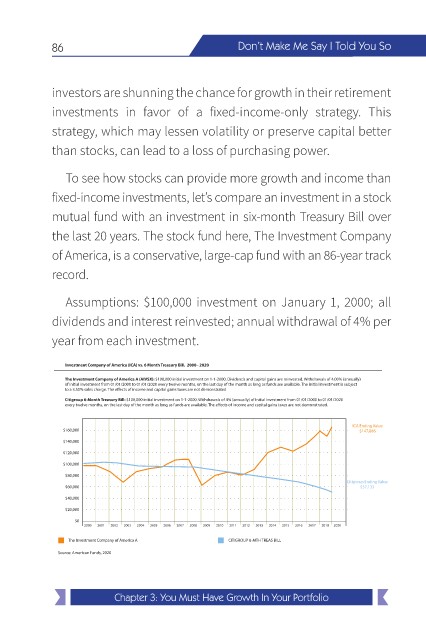

investors are shunning the chance for growth in their retirement

investments in favor of a fixed-income-only strategy. This

strategy, which may lessen volatility or preserve capital better

than stocks, can lead to a loss of purchasing power.

To see how stocks can provide more growth and income than

fixed-income investments, let’s compare an investment in a stock

mutual fund with an investment in six-month Treasury Bill over

the last 20 years. The stock fund here, The Investment Company

of America, is a conservative, large-cap fund with an 86-year track

record.

Assumptions: $100,000 investment on January 1, 2000; all

dividends and interest reinvested; annual withdrawal of 4% per

year from each investment.

Investment Company of America (ICA) vs. 6 Month Treasury Bill. 2000– 2020

The Investment Company of America A (AIVSX): $100,000 initial investment on 1-1-2000. Dividends and capital gains are reinvested. Withdrawals of 4.00% (annually)

of initial investment from 01/01/2000 to 01/01/2020 every twelve months, on the last day of the month as long as funds are available. The initial investment is subject

Citigroup 6-Month Treasury Bill: $100,000 initial investment on 1-1-2000. Withdrawals of 4% (annually) of Initial Investment from 01/01/2000 to 01/01/2020

ICA Ending Value

$160,000 $147,886

$140,000

$120,000

$100,000

$80,000

Citigroup Ending Value

$60,000 $57,133

$40,000

$20,000

$0

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2020

The Investment Company of America A CITIGROUP 6-MTH TREAS BILL

Source: American Funds, 2020

Chapter 3: You Must Have Growth In Your Portfolio