Page 70 - Ecobank Gambia Annual Report 2020

P. 70

Financial Statements & Annual Report

Notes to the Financial Statements

for the year ended 31 December 2020 (in Thousands of Gambian Dalasis)

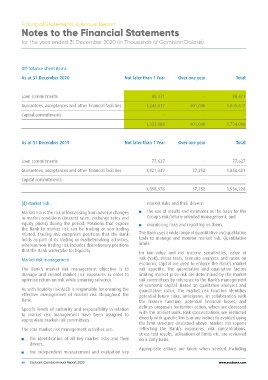

Off-balance sheet items Not later than 1 Year Over one year Total

As at 31 December 2020

Loan commitments 88,471 - 88,471

Guarantees, acceptances and other financial facilities 1,244,617 401,000 1,645,617

Capital commitments

- - -

1,333,088 401,000 1,734,088

As at 31 December 2019 Not later than 1 Year Over one year Total

Loan commitments 77,627 - 77,627

Guarantees, acceptances and other financial facilities 1,821,349 37,252 1,858,601

Capital commitments

- - -

1,898,976 37,252 1,936,228

(d) Market risk market risks and their drivers;

Market risk is the risk of loss arising from adverse changes ¦ the use of results and estimates as the basis for the

in market conditions (interest rates, exchange rates and

equity prices) during the period. Positions that expose Group’s risk/return-oriented management; and

the Bank to market risk can be trading or non-trading ¦ monitoring risks and reporting on them.

related. Trading risk comprises positions that the Bank The Bank uses a wide range of quantitative and qualitative

holds as part of its trading or market-making activities, tools to manage and monitor market risk. Quantitative

whereas non-trading risk includes discretionary positions limits

that the Bank undertake for liquidity. for fair value and net income sensitivities, value at

Market risk management risk (VaR), stress tests, scenario analyses and ratios on

The Bank’s market risk management objective is to economic capital are used to enforce the Bank’s market

manage and control market risk exposures in order to risk appetite. The quantitative and qualitative factors

optimise return on risk while ensuring solvency. limiting market price risk are determined by the market

As with liquidity risk ALCO is responsible for ensuring the risk committees by reference to the Bank’s management

effective management of market risk throughout the of economic capital. Based on qualitative analyses and

Bank. quantitative ratios, the market risk function identifies

Specific levels of authority and responsibility in relation potential future risks, anticipates, in collaboration with

to market risk management have been assigned to the finance function, potential financial losses, and

appropriate market risk committees. defines proposals for further action, which are discussed

The core market risk management activities are: with the market units. Risk concentrations are restricted

¦ the identification of all key market risks and their directly with specific limits or are indirectly avoided using

the limit structure described above. Market risk reports

drivers; reflecting the Bank’s exposures, risk concentrations,

¦ the independent measurement and evaluation key stress test results, utilisations of limits etc. are reviewed

on a daily basis.

68 Ecobank Gambia Annual Report 2020 Appropriate actions are taken when needed, including

www.ecobank.com