Page 65 - Ecobank Gambia Annual Report 2020

P. 65

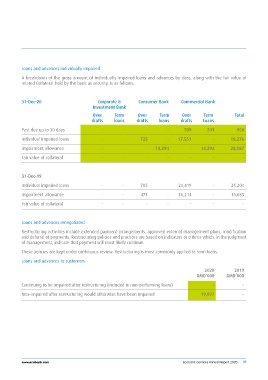

Loans and advances individually impaired

A breakdown of the gross amount of individually impaired loans and advances by class, along with the fair value of

related Collateral held by the bank as security, is as follows:

31-Dec-20 Corporate & Consumer Bank Commercial Bank

Investment Bank

Over Term Over Term Over Term Total

Past due up to 30 days drafts loans drafts loans drafts Loans

Individual impaired loans

Impairment allowance - - - - 709 241 950

Fair value of collateral

- - 725 - 17,551 - 18,276

- - - 14,294 - 14,294 28,587

- - - - - - -

31-Dec-19 - - 785 - 24,419 - 25,204

Individual impaired loans - 16,685

Impairment allowance - - 471 - 16,214 - -

Fair value of collateral

- - - - -

Loans and advances renegotiated

Restructuring activities include extended payment arrangements, approved external management plans, modification

and deferral of payments. Restructuring policies and practices are based on indicators or criteria which, in the judgment

of management, indicate that payment will most likely continue.

These policies are kept under continuous review. Restructuring is most commonly applied to term loans.

Loans and advances to customers

2020 2019

GMD’000 GMD’000

Continuing to be impaired after restructuring (included in non-performing loans) - -

Non-impaired after restructuring would otherwise have been impaired 19,977 -

www.ecobank.com Ecobank Gambia Annual Report 2020 63