Page 67 - Ecobank Gambia Annual Report 2020

P. 67

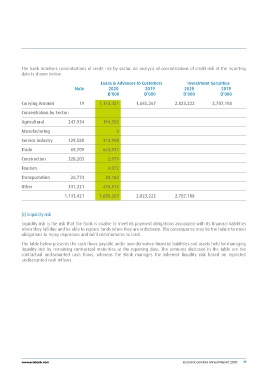

The bank monitors concentrations of credit risk by sector. An analysis of concentrations of credit risk at the reporting

date is shown below:

Loans & Advances to Customers Investment Securities

Note 2020 2019 2020 2019

D’000 D’000 D’000 D’000

Carrying Amount 19 1,113,421 1,685,267 2,823,222 2,707,108

Concentration by Sector:

Agricultural 247,934 194,702

Manufacturing 0

Service industry 129,580 313,908

Trade 69,709 663,931

Construction 328,203 2,979

Tourism 4,072

Transportation 26,774 30,162

Other 311,221 475,513

1,113,421 1,685,267 2,823,222 2,707,108

(c) Liquidity risk

Liquidity risk is the risk that the Bank is unable to meet its payment obligations associated with its financial liabilities

when they fall due and be able to replace funds when they are withdrawn. The consequence may be the failure to meet

obligations to repay depositors and fulfil commitments to lend.

The table below presents the cash flows payable under non-derivative financial liabilities and assets held for managing

liquidity risk by remaining contractual maturities at the reporting date. The amounts disclosed in the table are the

contractual undiscounted cash flows, whereas the Bank manages the inherent liquidity risk based on expected

undiscounted cash inflows.

www.ecobank.com Ecobank Gambia Annual Report 2020 65