Page 63 - Ecobank Gambia Annual Report 2020

P. 63

The above represents the maximum exposure to credit risk (2020: 41%); investments held in Government securities

at 31 December 2020 and 2019, without taking account represent 27% (2019: 22%).

of any collateral held or other credit enhancements Management is confident in its ability to continue

attached. For on-balance-sheet assets, the exposures set controlling and sustaining minimal exposure to credit risk

out above are based on net carrying amounts reported in arising from both its loans and advances portfolio and

the consolidated statement of financial position. investment securities.

As shown above, 43% of the total maximum exposure is

derived from loans and advances to banks and customers

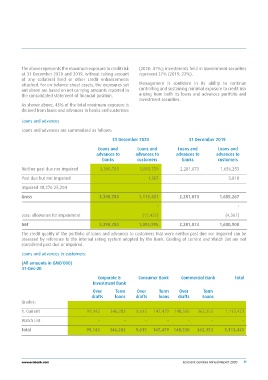

Loans and advances

Loans and advances are summarized as follows:

31 December 2020 31 December 2019

Loans and Loans and Loans and Loans and

advances to advances to advances to advances to

banks customers banks customers

Neither past due nor impaired 3,390,783 1,093,759 2,281,073 1,656,253

Past due but not impaired 1,387 3,810

Impaired 18,276 25,204

Gross 3,390,783 1,113,421 2,281,073 1,685,267

- -

Less: allowance for impairment (17,427) (4,367)

Net 3,390,783 1,095,995 2,281,073 1,680,900

The credit quality of the portfolio of loans and advances to customers that were neither past due nor impaired can be

assessed by reference to the internal rating system adopted by the Bank. Grading of current and Watch List are not

considered past due or impaired.

Loans and advances to customers:

(All amounts in GMD’000)

31-Dec-20

Corporate & Consumer Bank Commercial Bank Total

Investment Bank

Over Term Over Term Over Term

Grades: drafts loans drafts loans drafts Loans

1. Current 99,142 346,282 9,615 147,479 148,550 362,353 1,113,421

Watch List - - - - - - -

Total 99,142 346,282 9,615 147,479 148,550 362,353 1,113,421

www.ecobank.com Ecobank Gambia Annual Report 2020 61