Page 86 - Ecobank Gambia Annual Report 2020

P. 86

Financial Statements & Annual Report

Notes to the Financial Statements

for the year ended 31 December 2020 (in Thousands of Gambian Dalasis)

Management Fees: Ecobank Gambia is part of the Cash Transportation: This relates to cost of shipping of

Ecobank Group, as such we receive technical and foreign currency cash outside the country to fund our

management support from the Group. Management fees offshore accounts and also on behalf of our customers to

are expenses relating to shared cost for services received pay their suppliers for the importation of goods.

from the Group. Insurance: The increase in Insurance cost is due localization

Communication and Technology: As part of the Group of the All-Risk Insurance and Staff Life Assurance, these

Structure, information technology structure is centralized were previously paid on behalf of Affiliates by the Group

and operated by E-Process, this is owned by the Group Office and recharge back. Ecobank Gambia also increase

(ETI). This expenses relates to cost of our IT infrastructure its Cash cover insurance due inability to export foreign

and other related services received from E-Process. currency following the liquidation of previous Agent.

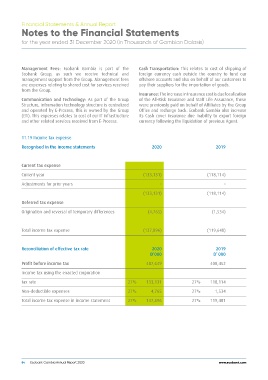

11.19 Income tax expense 2020 2019

Recognised in the income statements

Current tax expense (133,131) (118,114)

Current year - -

Adjustments for prior years

(133,131) (118,114)

Deferred tax expense

Origination and reversal of temporary differences (4,765) (1,534)

Total income tax expense (137,896) (119,648)

Reconciliation of effective tax rate 2020 2019

D’000 D’ 000

Profit before income tax 487,649 408,452

Income tax using the enacted corporation

tax rate 27% 133,131 27% 118,114

Non-deductible expenses 27% 4,765 27% 1,534

Total income tax expense in income statement 27% 27%

137,896 119,481

84 Ecobank Gambia Annual Report 2020 www.ecobank.com