Page 83 - Ecobank Gambia Annual Report 2020

P. 83

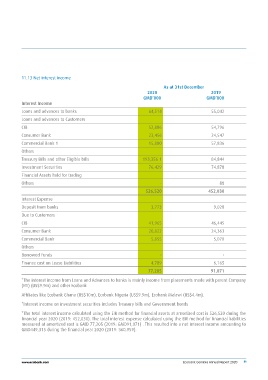

11.13 Net interest income

2020 As at 31st December 2019

GMD’000 GMD’000

Interest Income

Loans and advances to banks 64,514 55,042

Loans and advances to Customers

CIB 52,886 54,796

Consumer Bank 23,456 24,547

Commercial Bank 1 15,880 57,836

Others

Treasury Bills and other Eligible bills 193,356 1 84,844

Investment Securities 76,429 74,878

Financial Assets held for trading

Others - 88

526,520 452,030

Interest Expense

Deposit from banks 3,773 9,028

Due to Customers

CIB 41,965 46,445

Consumer Bank 20,822 24,363

Commercial Bank

Others 5,855 5,070

Borrowed Funds

Finance cost on Lease Liabilities - -

4,789 6,165

77,205 91,071

*The interest income from Loans and Advances to banks is mainly income from placements made with parent Company

(ETI) (US$9.9m) and other Ecobank

Affiliates like Ecobank Ghana (US$10m), Ecobank Nigeria (US$9.9m), Ecobank Malawi (US$4.4m).

*Interest income on investment securities includes Treasury bills and Government bonds

*The total interest income calculated using the EIR method for financial assets at amortized cost is 526,520 during the

financial year 2020 (2019: 452,030). The total interest expense calculated using the EIR method for financial liabilities

measured at amortized cost is GMD 77,205 (2019: GMD91,071) . This resulted into a net interest Income amounting to

GMD449,315 during the financial year 2020 (2019: 360,959).

www.ecobank.com Ecobank Gambia Annual Report 2020 81