Page 78 - Ecobank Gambia Annual Report 2020

P. 78

Financial Statements & Annual Report

Notes to the Financial Statements

for the year ended 31 December 2020 (in Thousands of Gambian Dalasis)

compliance policies and procedures. Compliance with a) Hold a minimum regulatory capital of GMD200 million;

such policies and procedures is the responsibility of all and

managers. (b) Maintain a ratio of total regulatory capital to risk-

(g) Capital management weighted assets plus risk weighted off- balance sheet

The Central Bank of the Gambia sets and monitors capital assets above a required minimum of 10%.

requirements for Banks. The Bank’s regulatory capital is divided into two tiers:

The Bank’s objectives when managing capital include: Tier 1 capital

¦ Complying with capital requirements set by the This includes shareholders’ equity which comprises of

ordinary share capital and retained earnings.

Central Bank of The Gambia Tier 2 capital

¦ Safeguarding the Bank’s ability to continue as a Includes qualifying subordinated loan debt and the

element of the fair value reserve relating to unrealized

going concern to enable it continue providing returns gainsmon equity instruments classified as available for

for shareholders and benefits for other stakeholders sale.

¦ Maintaining a strong capital base to support the The risk-weighted assets are measured as prescribed

development of its business by the Central Bank for both on and off- balance sheet

Capital adequacy and the use of regulatory capital are exposures. The Bank complied with all externally imposed

monitored daily by management, employing techniques capital requirements throughout the year. There have

based on guidelines developed by the Basel Committee been no material changes in the Bank’s management of

as implemented by Central Bank of The Gambia for capital during the year.

supervisory purposes. The required information is filed

with Central Bank of The Gambia on a monthly basis.

Central Bank of The Gambia requires each bank to:

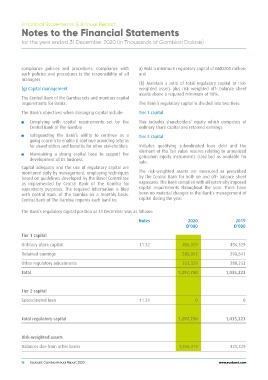

The Bank’s regulatory capital position at 31 December was as follows:

Notes 2020 2019

D’000 D’000

Tier 1 capital 456,329 456,329

588,093 298,641

Ordinary share capital 11.32 253,328 280,253

1,297,750 1,035,223

Retained earnings

Other regulatory adjustments

Total

Tier 2 capital 11.31 0 0

Subordinated loan

Total regulatory capital 1,297,750 1,035,223

Risk-weighted assets 1,356,313 325,329

Balances due from other banks

www.ecobank.com

76 Ecobank Gambia Annual Report 2020