Page 79 - Ecobank Gambia Annual Report 2020

P. 79

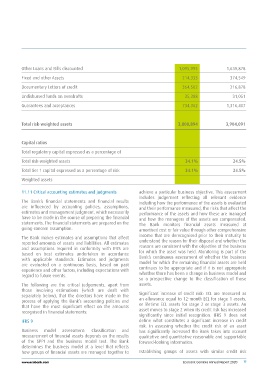

Other Loans and Bills discounted 1,095,995 1,639,878

Fixed and other Assets 214,333 374,549

Documentary Letters of credit 364,502 216,878

Undisbursed funds on overdrafts 35,388 31,051

Guarantees and acceptances 734,362

1,316,407

Total risk-weighted assets 3,800,894 3,904,091

Capital ratios 34.1% 24.5%

Total regulatory capital expressed as a percentage of 34.1% 24.5%

Total risk-weighted assets

Total tier 1 capital expressed as a percentage of risk

Weighted assets

11.11 Critical accounting estimates and judgments achieve a particular business objective. This assessment

The Bank’s financial statements and financial results includes judgement reflecting all relevant evidence

are influenced by accounting policies, assumptions, including how the performance of the assets is evaluated

estimates and management judgment, which necessarily and their performance measured, the risks that affect the

have to be made in the course of preparing the financial performance of the assets and how these are managed

statements. The financial statements are prepared on the and how the managers of the assets are compensated.

going-concern assumption. The Bank monitors financial assets measured at

The Bank makes estimates and assumptions that affect amortised cost or fair value through other comprehensive

reported amounts of assets and liabilities. All estimates income that are derecognised prior to their maturity to

and assumptions required in conformity with IFRS are understand the reason for their disposal and whether the

based on best estimates undertaken in accordance reasons are consistent with the objective of the business

with applicable standards. Estimates and judgments for which the asset was held. Monitoring is part of the

are evaluated on a continuous basis, based on past Bank’s continuous assessment of whether the business

experience and other factors, including expectations with model for which the remaining financial assets are held

regard to future events. continues to be appropriate and if it is not appropriate

The following are the critical judgements, apart from whether there has been a change in business model and

those involving estimations (which are dealt with so a prospective change to the classification of those

separately below), that the directors have made in the assets.

process of applying the Bank’s accounting policies and Significant increase of credit risk: ECL are measured as

that have the most significant effect on the amounts an allowance equal to 12-month ECL for stage 1 assets,

recognised in financial statements: or lifetime ECL assets for stage 2 or stage 3 assets. An

IFRS 9 asset moves to stage 2 when its credit risk has increased

Business model assessment: Classification and significantly since initial recognition. IFRS 9 does not

measurement of financial assets depends on the results define what constitutes a significant increase in credit

of the SPPI and the business model test. The Bank risk. In assessing whether the credit risk of an asset

determines the business model at a level that reflects has significantly increased the Bank takes into account

how groups of financial assets are managed together to qualitative and quantitative reasonable and supportable

forward-looking information.

www.ecobank.com Establishing groups of assets with similar credit risk

Ecobank Gambia Annual Report 2020 77