Page 28 - Agib Bank Limited Annual Report 2021

P. 28

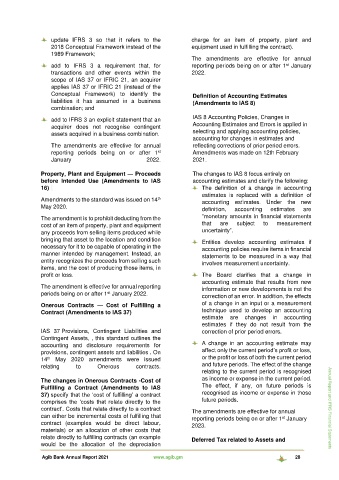

update IFRS 3 so that it refers to the charge for an item of property, plant and

2018 Conceptual Framework instead of the equipment used in fulfilling the contract).

1989 Framework;

The amendments are effective for annual

add to IFRS 3 a requirement that, for reporting periods being on or after 1 January

st

transactions and other events within the 2022.

scope of IAS 37 or IFRIC 21, an acquirer

applies IAS 37 or IFRIC 21 (instead of the

Conceptual Framework) to identify the Definition of Accounting Estimates

liabilities it has assumed in a business (Amendments to IAS 8)

combination; and

add to IFRS 3 an explicit statement that an IAS 8 Accounting Policies, Changes in

acquirer does not recognise contingent Accounting Estimates and Errors is applied in

assets acquired in a business combination. selecting and applying accounting policies,

accounting for changes in estimates and

The amendments are effective for annual reflecting corrections of prior period errors.

reporting periods being on or after 1 Amendments was made on 12th February

st

January 2022. 2021.

Property, Plant and Equipment — Proceeds The changes to IAS 8 focus entirely on

before Intended Use (Amendments to IAS accounting estimates and clarify the following:

16) ) The definition of a change in accounting

estimates is replaced with a definition of

Amendments to the standard was issued on 14 accounting estimates. Under the new

th

May 2020. definition, accounting estimates are

The amendment is to prohibit deducting from the “monetary amounts in financial statements

cost of an item of property, plant and equipment that are subject to measurement

any proceeds from selling items produced while uncertainty”.

bringing that asset to the location and condition Entities develop accounting estimates if

necessary for it to be capable of operating in the accounting policies require items in financial

manner intended by management. Instead, an statements to be measured in a way that

entity recognizes the proceeds from selling such involves measurement uncertainty.

items, and the cost of producing those items, in

profit or loss. The Board clarifies that a change in

accounting estimate that results from new

The amendment is effective for annual reporting information or new developments is not the

st

periods being on or after 1 January 2022.

correction of an error. In addition, the effects

Onerous Contracts — Cost of Fulfilling a of a change in an input or a measurement

Contract (Amendments to IAS 37) technique used to develop an accounting

estimate are changes in accounting

estimates if they do not result from the

IAS 37 Provisions, Contingent Liabilities and correction of prior period errors.

Contingent Assets, , this standard outlines the

accounting and disclosure requirements for A change in an accounting estimate may

provisions, contingent assets and liabilities . On affect only the current period’s profit or loss,

th

14 May 2020 amendments were issued or the profit or loss of both the current period

relating to Onerous contracts. and future periods. The effect of the change

relating to the current period is recognised

The changes in Onerous Contracts -Cost of as income or expense in the current period.

Fulfilling a Contract (Amendments to IAS The effect, if any, on future periods is

37) specify that the ‘cost of fulfilling’ a contract recognised as income or expense in those

comprises the ‘costs that relate directly to the future periods.

contract’. Costs that relate directly to a contract The amendments are effective for annual Annual Report and IFRS Financial Statements

can either be incremental costs of fulfilling that reporting periods being on or after 1 January

st

contract (examples would be direct labour, 2023.

materials) or an allocation of other costs that

relate directly to fulfilling contracts (an example Deferred Tax related to Assets and

would be the allocation of the depreciation

Agib Bank Annual Report 2021 www.agib.gm 28