Page 11 - 2017 UFSTSG Investment Pres

P. 11

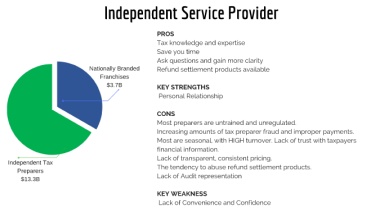

Independent Service Provider

PROS

Tax knowledge and expertise

Save you time

Ask questions and gain more clarity

Nationally Branded Refund settlement products available

Franchises

$3.7B KEY STRENGTHS

Personal Relationship

CONS

Most preparers are untrained and unregulated.

Increasing amounts of tax preparer fraud and improper payments.

Most are seasonal, with HIGH turnover. Lack of trust with taxpayers

financial information.

Lack of transparent, consistent pricing.

Independent Tax

Preparers The tendency to abuse refund settlement products.

$13.3B Lack of Audit representation

KEY WEAKNESS

Lack of Convenience and Confidence