Page 13 - Burlingame EE Guide 12-17

P. 13

BENEFITS

Retirement Savings

Burlingame Industries is dedicated to your success at work and committed to helping you to achieve your retirement goals. With

that in mind, as of January 1, 2017 our Profit Sharing Retirement Plan was modified, to add the AFTER TAX deferral savings option

called ROTH 401(k), and to lower the eligibility requirement age to 18 years of age instead of 21. By making these modifications to

the plan, it will continue to help you accumulate the assets you will need for retirement. For more details on these revisions, please

refer to the Summary of Material Modification handout recently distributed, or contact Human Resources.

As an eligible employee, you are eligible to participate in the plan and will be automatically enrolled the first day of the month

following 30 days of successful service.

Profit Sharing

Each year, Burlingame Industries decides whether to make a profit sharing contribution. Your share of contribution is based on

your pay compared to the pay of all plan participants. These contributions grow tax-deferred. You receive profit sharing

contributions, if you work at least 1,000 hours in a plan year and remain employed on the last day of the plan year. Participants

who retire, die or become disabled during the plan year also receive profit sharing contributions.

Charles Schwab | 401(k) Retirement Plan

The 401(k) Retirement Plan is voluntary, and allows you to contribute toward your retirement on a pre-tax or after-tax basis

through payroll deductions. Burlingame Industries will match your contributions with $0.60 per $1.00 contributed, on the first 5%

of your gross annual pay.

Catch-up: If you reach age 50 or are over age 50 in 2017, you can make additional pre-tax “or catch up” contributions above and

beyond the normal plan & legal limits.

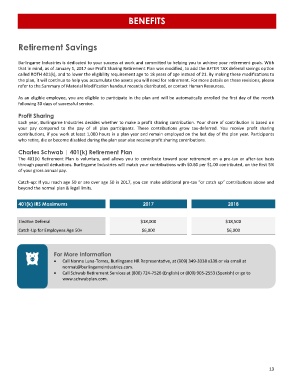

401(k) IRS Maximums 2017 2018

Elective Deferral $18,000 $18,500

Catch-Up for Employees Age 50+ $6,000 $6,000

For More Information

• Call Norma Luna-Torres, Burlingame HR Representative, at (909) 349-3338 x338 or via email at

normat@burlingameindustries.com.

• Call Schwab Retirement Services at (800) 724-7526 (English) or (800) 905-2553 (Spanish) or go to

www.schwabplan.com.

13