Page 9 - Rampart EE Guide 01-19 (flipbook)

P. 9

BENEFITS

DENTAL INSURANCE

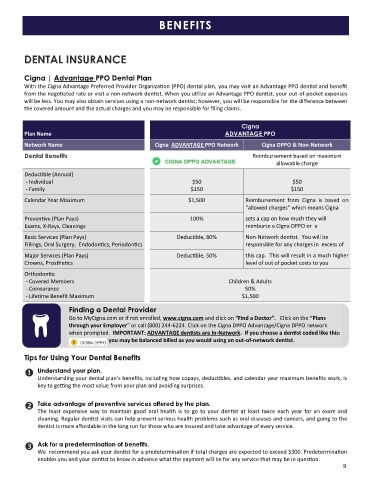

Cigna | Advantage PPO Dental Plan

With the Cigna Advantage Preferred Provider Organization (PPO) dental plan, you may visit an Advantage PPO dentist and benefit

from the negotiated rate or visit a non‐network dentist. When you utilize an Advantage PPO dentist, your out-of-pocket expenses

will be less. You may also obtain services using a non-network dentist; however, you will be responsible for the difference between

the covered amount and the actual charges and you may be responsible for filing claims.

Cigna

Plan Name ADVANTAGE PPO

Network Name Cigna ADVANTAGE PPO Network Cigna DPPO & Non-Network

Dental Benefits Reimbursement based on maximum

allowable charge

Deductible (Annual)

- Individual $50 $50

- Family $150 $150

Calendar Year Maximum $1,500 Reimbursement from Cigna is based on

“allowed charges” which means Cigna

Preventive (Plan Pays) 100% sets a cap on how much they will

Exams, X-Rays, Cleanings reimburse a Cigna DPPO or a

Basic Services (Plan Pays) Deductible, 80% Non-Network dentist. You will be

Fillings, Oral Surgery, Endodontics, Periodontics responsible for any charges in excess of

Major Services (Plan Pays) Deductible, 50% this cap. This will result in a much higher

Crowns, Prosthetics level of out of pocket costs to you

Orthodontia

- Covered Members Children & Adults

- Coinsurance 50%

- Lifetime Benefit Maximum $1,500

Finding a Dental Provider

Go to MyCigna.com or if not enrolled, www.cigna.com and click on “Find a Doctor”. Click on the “Plans

through your Employer” or call (800) 244-6224. Click on the Cigna DPPO Advantage/Cigna DPPO network

when prompted. IMPORTANT: ADVANTAGE dentists are In-Network. If you choose a dentist coded like this:

you may be balanced billed as you would using an out-of-network dentist.

Tips for Using Your Dental Benefits

Understand your plan.

Understanding your dental plan’s benefits, including how copays, deductibles, and calendar year maximum benefits work, is

key to getting the most value from your plan and avoiding surprises.

Take advantage of preventive services offered by the plan.

The least expensive way to maintain good oral health is to go to your dentist at least twice each year for an exam and

cleaning. Regular dentist visits can help prevent serious health problems such as oral diseases and cancers, and going to the

dentist is more affordable in the long run for those who are insured and take advantage of every service.

Ask for a predetermination of benefits.

We recommend you ask your dentist for a predetermination if total charges are expected to exceed $300. Predetermination

enables you and your dentist to know in advance what the payment will be for any service that may be in question.

9