Page 19 - ABC - Tech BG_1A

P. 19

Voluntary Plans 17

Voluntary Legal/Identity Theft Plans

LegalShield

ABC Company offers employees LegalShield, a voluntary legal plan. This plan offers benefits that help

protect you and your eligible family members by providing preventive legal services, trial defense services

and other legal assistance. Services include:

• Unlimited phone consultations with attorneys regarding unlimited matters

• Document review (up to 15 pages per document).

• Will preparation and durable power of attorney

• Residential loan document review

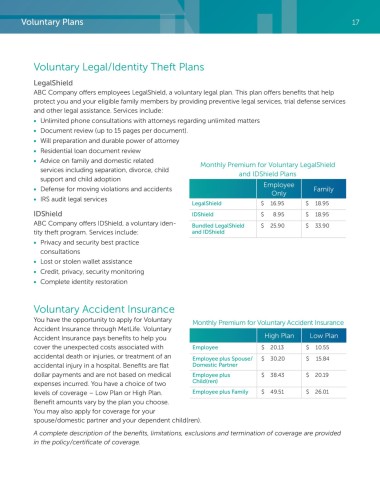

• Advice on family and domestic related Monthly Premium for Voluntary LegalShield

services including separation, divorce, child and IDShield Plans

support and child adoption

Employee

• Defense for moving violations and accidents Family

Only

• IRS audit legal services

LegalShield $ 16.95 $ 18.95

IDShield IDShield $ 8.95 $ 18.95

ABC Company offers IDShield, a voluntary iden- Bundled LegalShield $ 25.90 $ 33.90

tity theft program. Services include: and IDShield

• Privacy and security best practice

consultations

• Lost or stolen wallet assistance

• Credit, privacy, security monitoring

• Complete identity restoration

Voluntary Accident Insurance

You have the opportunity to apply for Voluntary Monthly Premium for Voluntary Accident Insurance

Accident Insurance through MetLife. Voluntary

Accident Insurance pays benefits to help you High Plan Low Plan

cover the unexpected costs associated with Employee $ 20.13 $ 10.55

accidental death or injuries, or treatment of an Employee plus Spouse/ $ 30.20 $ 15.84

accidental injury in a hospital. Benefits are flat Domestic Partner

dollar payments and are not based on medical Employee plus $ 38.43 $ 20.19

expenses incurred. You have a choice of two Child(ren)

levels of coverage – Low Plan or High Plan. Employee plus Family $ 49.51 $ 26.01

Benefit amounts vary by the plan you choose.

You may also apply for coverage for your

spouse/domestic partner and your dependent child(ren).

A complete description of the benefits, limitations, exclusions and termination of coverage are provided

in the policy/certificate of coverage.