Page 16 - Palomar EE Guide 01-19 FINAL

P. 16

Financial Wellness

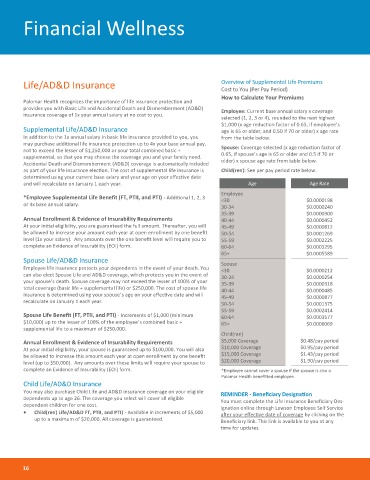

Life/AD&D Insurance Overview of Supplemental Life Premiums

Cost to You (Per Pay Period)

How to Calculate Your Premiums

Palomar Health recognizes the importance of life insurance protection and

provides you with Basic Life and Accidental Death and Dismemberment (AD&D)

Employee: Current base annual salary x coverage

insurance coverage of 1x your annual salary at no cost to you.

selected (1, 2, 3 or 4), rounded to the next highest

$1,000 (x age reduction factor of 0.65, if employee’s

Supplemental Life/AD&D Insurance age is 65 or older, and 0.50 if 70 or older) x age rate

In addition to the 1x annual salary in basic life insurance provided to you, you from the table below.

may purchase additional life insurance protection up to 4x your base annual pay,

not to exceed the lesser of $1,250,000 or your total combined basic + Spouse: Coverage selected (x age reduction factor of

supplemental, so that you may choose the coverage you and your family need. 0.65, if spouse’s age is 65 or older and 0.5 if 70 or

Accidental Death and Dismemberment (AD&D) coverage is automatically included older) x spouse age rate from table below.

as part of your life insurance election. The cost of supplemental life insurance is Child(ren): See per pay period rate below.

determined using your current base salary and your age on your effective date

and will recalculate on January 1 each year. Age Age Rate

Employee

*Employee Supplemental Life Benefit (FT, PTII, and PTI) - Additional 1, 2, 3 <30 $0.0000198

or 4x base annual salary.

30-34 $0.0000240

35-39 $0.0000300

Annual Enrollment & Evidence of Insurability Requirements 40-44 $0.0000452

At your initial eligibility, you are guaranteed the full amount. Thereafter, you will 45-49 $0.0000812

be allowed to increase your amount each year at open enrollment by one benefit 50-54 $0.0001269

level (1x your salary). Any amounts over the one benefit level will require you to 55-59 $0.0002225

complete an Evidence of Insurability (EOI) form. 60-64 $0.0003295

65+ $0.0005589

Spouse Life/AD&D Insurance

Spouse

Employee life insurance protects your dependents in the event of your death. You <30 $0.0000212

can also elect Spouse Life and AD&D coverage, which protects you in the event of 30-34 $0.0000254

your spouse’s death. Spouse coverage may not exceed the lesser of 100% of your 35-39 $0.0000318

total coverage (basic life + supplemental life) or $250,000. The cost of spouse life 40-44 $0.0000485

insurance is determined using your spouse’s age on your effective date and will 45-49 $0.0000877

recalculate on January 1 each year. 50-54 $0.0001375

55-59 $0.0002414

Spouse Life Benefit (FT, PTII, and PTI) - Increments of $1,000 (minimum 60-64 $0.0003577

$10,000) up to the lesser of 100% of the employee’s combined basic + 65+ $0.0006069

supplemental life to a maximum of $250,000.

Child(ren)

Annual Enrollment & Evidence of Insurability Requirements $5,000 Coverage $0.48/pay period

$10,000 Coverage $0.95/pay period

At your initial eligibility, your spouse is guaranteed up to $100,000. You will also

$15,000 Coverage $1.43/pay period

be allowed to increase this amount each year at open enrollment by one benefit

$20,000 Coverage $1.90/pay period

level (up to $50,000). Any amounts over these limits will require your spouse to

complete an Evidence of Insurability (EOI) form. *Employee cannot cover a spouse if the spouse is also a

Palomar Health benefitted employee.

Child Life/AD&D Insurance

You may also purchase Child Life and AD&D insurance coverage on your eligible REMINDER - Beneficiary Designation

dependents up to age 26. The coverage you select will cover all eligible You must complete the Life Insurance Beneficiary Des-

dependent children for one cost. ignation online through Lawson Employee Self Service

• Child(ren) Life/AD&D FT, PTII, and PTI) - Available in increments of $5,000

after your effective date of coverage by clicking on the

up to a maximum of $20,000. All coverage is guaranteed.

Beneficiary link. This link is available to you at any

time for updates.

16