Page 13 - Casting Network Benefits Guide 2020

P. 13

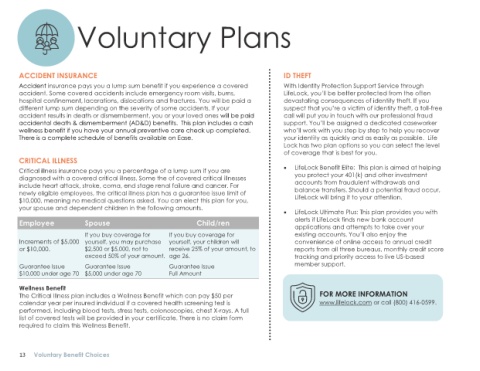

Voluntary Plans

ACCIDENT INSURANCE ID THEFT

Accident insurance pays you a lump sum benefit if you experience a covered With Identity Protection Support Service through

accident. Some covered accidents include emergency room visits, burns, LifeLock, you’ll be better protected from the often

hospital confinement, lacerations, dislocations and fractures. You will be paid a devastating consequences of identity theft. If you

different lump sum depending on the severity of some accidents. If your suspect that you’re a victim of identity theft, a toll-free

accident results in death or dismemberment, you or your loved ones will be paid call will put you in touch with our professional fraud

accidental death & dismemberment (AD&D) benefits. This plan includes a cash support. You’ll be assigned a dedicated caseworker

wellness benefit if you have your annual preventive care check up completed. who’ll work with you step by step to help you recover

There is a complete schedule of benefits available on Ease. your identity as quickly and as easily as possible. Life

Lock has two plan options so you can select the level

of coverage that is best for you.

CRITICAL ILLNESS

Critical illness insurance pays you a percentage of a lump sum if you are • LifeLock Benefit Elite: This plan is aimed at helping

diagnosed with a covered critical illness. Some the of covered critical illnesses you protect your 401(k) and other investment

accounts from fraudulent withdrawals and

include heart attack, stroke, coma, end stage renal failure and cancer. For

newly eligible employees, the critical illness plan has a guarantee issue limit of balance transfers. Should a potential fraud occur,

$10,000, meaning no medical questions asked. You can elect this plan for you, LifeLock will bring it to your attention.

your spouse and dependent children in the following amounts.

• LifeLock Ultimate Plus: This plan provides you with

Employee Spouse Child/ren alerts if LifeLock finds new bank account

applications and attempts to take over your

If you buy coverage for If you buy coverage for existing accounts. You’ll also enjoy the

Increments of $5,000 yourself, you may purchase yourself, your children will convenience of online access to annual credit

or $10,000. $2,500 or $5,000, not to receive 25% of your amount, to reports from all three bureaus, monthly credit score

exceed 50% of your amount. age 26. tracking and priority access to live US-based

Guarantee Issue Guarantee Issue Guarantee Issue member support.

$10,000 under age 70 $5,000 under age 70 Full Amount

Wellness Benefit

The Critical Illness plan includes a Wellness Benefit which can pay $50 per FOR MORE INFORMATION

calendar year per insured individual if a covered health screening test is www.lifelock.com or call (800) 416-0599.

performed, including blood tests, stress tests, colonoscopies, chest X-rays. A full

list of covered tests will be provided in your certificate. There is no claim form

required to claim this Wellness Benefit.

13 Voluntary Benefit Choices