Page 19 - CHSI Benefit Guide 2019-2020

P. 19

Flexible Spending Accounts

Anthem Blue Cross | Flexible Spending Accounts

You can set aside money in Flexible Spending Accounts (FSA) before taxes are deducted to pay for certain health and

dependent care expenses, lowering your taxable income and increasing your take home pay. Only expenses for services

incurred during the plan year are eligible for reimbursement from your accounts. Please remember that if you are using your

debit card, you must save your receipts, just in case Anthem Blue Cross needs a copy for verification. Also, all receipts should

be itemized to reflect what product or service was purchased. Credit card receipts are not sufficient per IRS guidelines.

Health Care Spending Account

This plan is used to pay for expenses not covered under your health plans, such as deductibles, coinsurance, copays and

expenses that exceed plan limits. Employees may defer up to $1,500 pre‐tax per year. Please note, HSA medical participants

may only participate in Health Care Spending Account to cover out-of-pocket Dental and Vision expenses through the Limited

Purpose Plan.

Dependent Care Assistance Plan

This plan is used to pay for eligible expenses you incur for child care, or for the care of a disabled dependent, while you work.

Employees may defer up to $5,000 pre-tax per year.

FSAs offer sizable tax advantages. The trade-off is that these accounts are subject to strict IRS regulations, including the use-

it-or-lose-it rule. According to this rule, you must forfeit any money left in your account(s) after your expenses for the year

have been reimbursed. The IRS does not allow the return of unused account balances at the end of the plan year, and

remaining balances cannot be carried forward to a future plan year. If you are unable to estimate your health care expenses

accurately, it is better to be conservative and underestimate rather than overestimate your expenses.

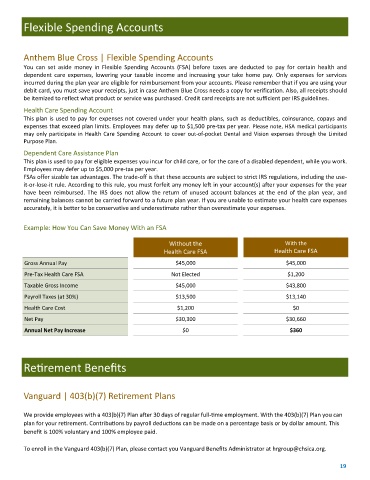

Example: How You Can Save Money With an FSA

Without the With the

Health Care FSA Health Care FSA

Gross Annual Pay $45,000 $45,000

Pre-Tax Health Care FSA Not Elected $1,200

Taxable Gross Income $45,000 $43,800

Payroll Taxes (at 30%) $13,500 $13,140

Health Care Cost $1,200 $0

Net Pay $30,300 $30,660

Annual Net Pay Increase $0 $360

Retirement Benefits

Vanguard | 403(b)(7) Retirement Plans

We provide employees with a 403(b)(7) Plan after 30 days of regular full-time employment. With the 403(b)(7) Plan you can

plan for your retirement. Contributions by payroll deductions can be made on a percentage basis or by dollar amount. This

benefit is 100% voluntary and 100% employee paid.

To enroll in the Vanguard 403(b)(7) Plan, please contact you Vanguard Benefits Administrator at hrgroup@chsica.org.

19