Page 25 - Lyon Benefits Guide 01-18 National - FINAL

P. 25

PET INSURANCE

NATIONWIDE PET INSURANCE | REIMBURSEMENT PLAN

With the Nationwide Pet Insurance reimbursement plan, you can visit any licensed veterinarian, veterinary specialist or animal hospital

in the United States. To receive reimbursements through Nationwide, fax or mail their easy-to-use claim form along with your invoices.

After meeting your policy’s deductible, you will be reimbursed according to your plan’s benefit schedule allowance or the invoice amount,

whichever is less. If elected, you will own this policy and pay premiums to Nationwide directly.

FOR MORE INFORMATION OR TO ENROLL

Go to www.petsnationwide.com or call (877) 738-7874.

RETIREMENT SAVINGS

FIDELITY INVESTMENTS | 401(K)

You are encouraged to participate in Lyon Living’s 401(k) plan with Fidelity Investments. This plan allows you to fund for your retirement

with pre-tax dollars. You may defer from 1% to 100% of compensation on a pre-tax basis up to the IRS allowable maximum of $18,500

for 2018. If you will be age 50 or older during the year, you may defer an additional “catch-up” contribution (up to $6,000 for 2018). You

may increase or decrease the amount you are contributing each pay period. Employee-directed investments are available, with more than

25 choices to suit your own retirement savings approach, investment objectives, and comfort level with risk (low to high).

Lyon Living may make discretionary matching contributions to the plan following each plan year end (December 31st). There is a 5 year

vesting schedule. You are 100% vested after five years, and are always 100% vested in what you contribute.

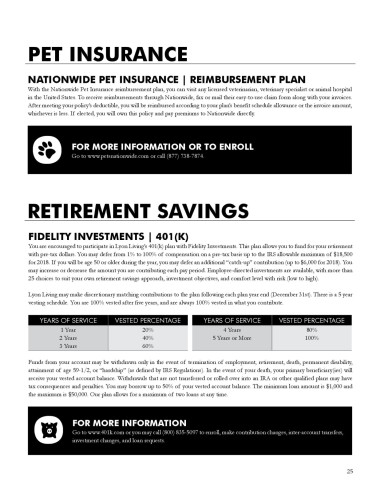

YEARS OF SERVICE VESTED PERCENTAGE YEARS OF SERVICE VESTED PERCENTAGE

1 Year 20% 4 Years 80%

2 Years 40% 5 Years or More 100%

3 Years 60%

Funds from your account may be withdrawn only in the event of termination of employment, retirement, death, permanent disability,

attainment of age 59-1/2, or “hardship” (as defined by IRS Regulations). In the event of your death, your primary beneficiary(ies) will

receive your vested account balance. Withdrawals that are not transferred or rolled over into an IRA or other qualified plans may have

tax consequences and penalties. You may borrow up to 50% of your vested account balance. The minimum loan amount is $1,000 and

the maximum is $50,000. Our plan allows for a maximum of two loans at any time.

FOR MORE INFORMATION

Go to www.401k.com or you may call (800) 835-5097 to enroll, make contribution changes, inter-account transfers,

investment changes, and loan requests.

25