Page 20 - American Business Bank EE Guide 01-19 - C2

P. 20

Parking and Transportation

Parking and Transportation

American Business Bank offers employer paid parking or transportation in the amount of $260 per month. Costs in excess of IRS

allowance are considered taxable income and will be applied in payroll.

Paid Time Off

Vacation

Vacation starts to accrue on the first day of employment and may be taken without being fully accrued as approved by your

immediate supervisor.

As a full-time employee, you will accrue 3.08 hours of vacation per payroll for a total of ten (10) days vacation per year. Full time

employees (non officers) will also receive an additional vacation day for each year worked up to fifteen (15) days of vacation per

year.

Sick Time

As a full time employee, you will accrue 3.70 hours of sick time per payroll. Sick pay not used during the year will be carried over

for use in subsequent years up to a maximum accrual of 480 hours or sixty (60) days.

Part time or modified time employees will accrue a pro rata portion of the full time allotment based on their standard scheduled

hours worked per week.

Retirement Savings

Pension Architects | 401(k)

You are encouraged to participate in American Business Bank’s 401(k) plan. This plan allows you to fund your retirement with pre‐

tax dollars. You can defer up to 100% of your annual salary up to IRS benefit maximums. If you are 50 years old or older during the plan

year, you may contribute a catch-up deferral.

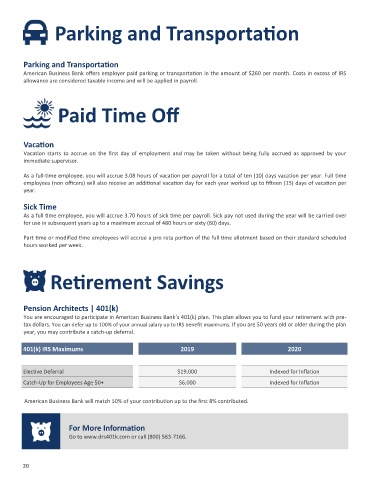

401(k) IRS Maximums 2019 2020

Elective Deferral $19,000 Indexed for Inflation

Catch-Up for Employees Age 50+ $6,000 Indexed for Inflation

American Business Bank will match 50% of your contribution up to the first 8% contributed.

For More Information

Go to www.drs401k.com or call (800) 563-7166.

20