Page 2 - Coast Sign Benefit Summary 2017 - Non- CA - sent 9.26.17

P. 2

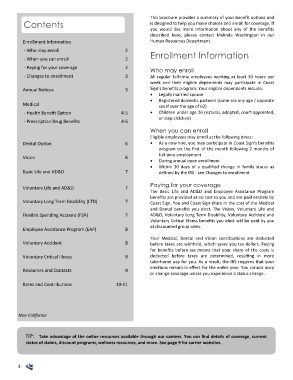

Contents is designed to help you make choices and enroll for coverage. If

This brochure provides a summary of your benefit options and

Contents

you would like more information about any of the benefits

described here, please contact Melinda Washington in our

Enrollment Information Human Resources Department.

- Who may enroll 2 Enrollment Information

- When you can enroll 2

- Paying for your coverage 2

Who may enroll

- Changes to enrollment 3 All regular full‐time employees working at least 30 hours per

week and their eligible dependents may participate in Coast

Annual Notices 3 Sign’s benefits program. Your eligible dependents include:

• Legally married spouse

• Registered domestic partners (same sex any age / opposite

Medical sex if over the age of 62)

- Health Benefit Option 4-5 • Children under age 26 (natural, adopted, court-appointed,

or step children)

- Prescription Drug Benefits 4-5

When you can enroll

Eligible employees may enroll at the following times:

Dental Option 6 • As a new hire, you may participate in Coast Sign’s benefits

program on the first of the month following 2 months of

full‐time employment

Vision 6

• During annual open enrollment

• Within 30 days of a qualified change in family status as

Basic Life and AD&D 7 defined by the IRS - see Changes to enrollment

Paying for your coverage

Voluntary Life and AD&D 7

The Basic Life and AD&D and Employee Assistance Program

benefits are provided at no cost to you and are paid entirely by

Voluntary Long Term Disability (LTD) 7 Coast Sign. You and Coast Sign share in the cost of the Medical

and Dental benefits you elect. The Vision, Voluntary Life and

Flexible Spending Account (FSA) 7 AD&D, Voluntary Long Term Disability, Voluntary Accident and

Voluntary Critical Illness benefits you elect will be paid by you

Employee Assistance Program (EAP) 8 at discounted group rates.

Your Medical, Dental and Vision contributions are deducted

Voluntary Accident 8 before taxes are withheld, which saves you tax dollars. Paying

for benefits before‐tax means that your share of the costs is

Voluntary Critical Illness 8 deducted before taxes are determined, resulting in more

take‐home pay for you. As a result, the IRS requires that your

elections remain in effect for the entire year. You cannot drop

Resources and Contacts 9

or change coverage unless you experience a status change.

Rates and Contributions 10-11

Non-California

TIP: Take advantage of the online resources available through our carriers. You can find details of coverage, current

status of claims, discount programs, wellness resources, and more. See page 9 for carrier websites.

2