Page 4 - Coast Sign Benefit Summary 2017 - Non- CA - sent 9.26.17

P. 4

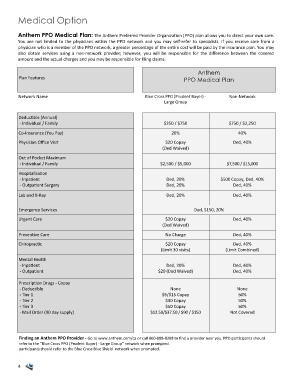

Medical Option

Anthem PPO Medical Plan: The Anthem Preferred Provider Organization (PPO) plan allows you to direct your own care.

You are not limited to the physicians within the PPO network and you may self-refer to specialists. If you receive care from a

physician who is a member of the PPO network, a greater percentage of the entire cost will be paid by the insurance plan. You may

also obtain services using a non‐network provider; however, you will be responsible for the difference between the covered

amount and the actual charges and you may be responsible for filing claims.

Anthem

Plan Features

PPO Medical Plan

Network Name Blue Cross PPO (Prudent Buyer) - Non-Network

Large Group

Deductible (Annual)

- Individual / Family $250 / $750 $750 / $2,250

Co-Insurance (You Pay) 20% 40%

Physician Office Visit $20 Copay Ded, 40%

(Ded Waived)

Out of Pocket Maximum

- Individual / Family $2,500 / $5,000 $7,500 / $15,000

Hospitalization

- Inpatient Ded, 20% $500 Copay, Ded, 40%

- Outpatient Surgery Ded, 20% Ded, 40%

Lab and X-Ray Ded, 20% Ded, 40%

Emergency Services Ded, $150, 20%

Urgent Care $20 Copay Ded, 40%

(Ded Waived)

Preventive Care No Charge Ded, 40%

Chiropractic $20 Copay Ded, 40%

(Limit 30 visits) (Limit Combined)

Mental Health

- Inpatient Ded, 20% Ded, 40%

- Outpatient $20 (Ded Waived) Ded, 40%

Prescription Drugs - Copay

- Deductible None None

- Tier 1 $5/$15 Copay 50%

- Tier 2 $30 Copay 50%

- Tier 3 $50 Copay 50%

- Mail Order (90 day supply) $12.50/$37.50 / $90 / $150 Not Covered

Finding an Anthem PPO Provider - Go to www.anthem.com/ca or call 800-888-8288 to find a provider near you. PPO participants should

refer to the “Blue Cross PPO (Prudent Buyer) - Large Group” network when prompted.

participants should refer to the Blue Cross Blue Shield network when prompted.

4