Page 133 - inside page.cdr

P. 133

ANNUAL REPORT 2018 - 2019

NOTES FORMING PART OF THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 3 1ST MARCH 201 9

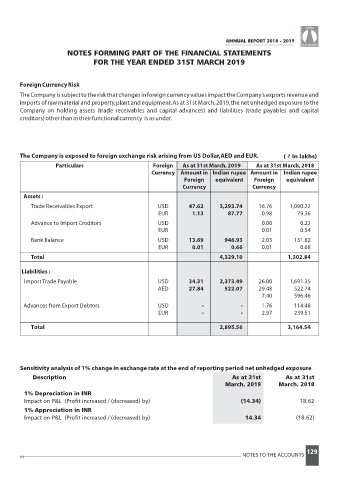

ForeignCurrencyRisk

TheCompanyissubjecttotheriskthatchangesinforeigncurrencyvaluesimpacttheCompany’sexportsrevenueand

imports of raw material and property,plant and equipment.As at 31st March,2019,the net unhedged exposure to the

Company on holding assets (trade receivables and capital advances) and liabilities (trade payables and capital

creditors)otherthanintheirfunctionalcurrency isasunder.

The Company is exposed to foreign exchange risk arising from US Dollar,AED and EUR. ( ` in lakhs)

Particulars Foreign As at 31st March,201 9 As at 31st March,201 8

Currency Amount in Indian rupee Amount in Indian rupee

Foreign equivalent Foreign equivalent

Currency Currency

Assets :

Trade Receivables Export USD 47.62 3,293.74 16.76 1,090.22

EUR 1.13 87.77 0.98 79.36

Advance to Import Creditors USD 0.00 0.23

EUR 0.01 0.54

Bank Balance USD 13.69 946.93 2.03 131.82

EUR 0.01 0.66 0.01 0.68

Total 4,329.10 1,302.84

Liabilities :

Import Trade Payable USD 34.31 2,373.49 26.00 1,691.35

AED 27.84 522.07 29.48 522.74

7.40 596.46

Advances from Export Debtors USD - - 1.76 114.48

EUR - - 2.97 239.51

Total 2,895.56 3,164.54

Sensitivity analysis of 1% change in exchange rate at the end of reporting period net unhedged exposure

Description As at 31st As at 31st

March, 201 9 March, 201 8

1% Depreciation in INR

Impact on P&L (Pro t increased / (decreased) by) (14.34) 18.62

1% Appreciation in INR

Impact on P&L (Pro t increased / (decreased) by) 14.34 (18.62)

129

NOTES TO THE ACCOUNTS