Page 131 - inside page.cdr

P. 131

ANNUAL REPORT 2018 - 2019

NOTES FORMING PART OF THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 3 1ST MARCH 201 9

The efinebenefitplansexposetotheCompd any toanumberofactuarialrisk

a) InvestmentRisk: Thepresentvalueofthedefinedbenefitplanliabilityiscalculatedusingadiscountratedetermined

by reference to government/high quality bond yields;if the return on plan asset is below this rate,it will create a plan

deficit.

b) Interest Risk : A decrease in the bond interest rate will increase the plan liability;however,this will be partially offset

byanincreaseinthereturnontheplan’sdebtinvestments.

c) Salary Risk : The present value of the defined benefit plan liability is calculated by reference to the future salaries of

planparticipants.Assuch,anincreaseinthesalaryoftheplanparticipantswillincreasetheplan’sliability.

d) Longevity Risk : The present value of the defined benefit plan liability is calculated by reference to the best estimate

of the mortality of plan participants both during and after their employment.An increase in the life expectancy of the

planparticipantswillincreasetheplan’sliability.

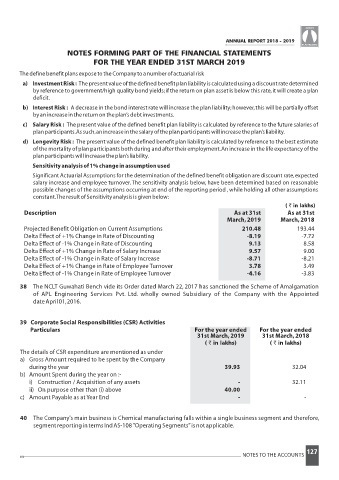

Sensitivityanalysisof1%changeinassumptionused

Significant Actuarial Assumptions for the determination of the defined benefit obligation are discount rate,expected

salary increase and employee turnover.The sensitivity analysis below, have been determined based on reasonable

possible changes of the assumptions occurring at end of the reporting period ,while holding all other assumptions

constant.TheresultofSensitivityanalysisisgivenbelow:

( ` in lakhs)

Description As at 31st As at 31st

March,201 9 March,201 8

Projected Benefit Obligation on Current Assumptions 210.48 193.44

Delta Effect of +1% Change in Rate of Discounting -8.19 -7.72

Delta Effect of -1% Change in Rate of Discounting 9.13 8.58

Delta Effect of +1% Change in Rate of Salary Increase 9.57 9.00

Delta Effect of -1% Change in Rate of Salary Increase -8.71 -8.21

Delta Effect of +1% Change in Rate of Employee Turnover 3.78 3.49

Delta Effect of -1% Change in Rate of Employee Turnover -4.16 -3.83

38 The NCLT Guwahati Bench vide its Order dated March 22, 2017 has sanctioned the Scheme of Amalgamation

of APL Engineering Services Pvt. Ltd. wholly owned Subsidiary of the Company with the Appointed

dateApril01,2016.

39 Corporate Social Responsibilities (CSR) Activities

Particulars For the year ended For the year ended

31st March,2019 31st March,2018

( ` in lakhs) ( ` in lakhs)

The details of CSR expenditure are mentioned as under

a) Gross Amount required to be spent by the Company

during the year 39.93 32.04

b) Amount Spent during the year on :-

i) Construction / Acquisition of any assets - 3 211.

ii) On purpose other than ( i) above 40.00

c) Amount Payable as at Year End - -

40 The Company's main business is Chemical manufacturing falls within a single business segment and therefore,

segmentreportingintermsIndAS-108"OperatingSegments"isnotapplicable.

127

NOTES TO THE ACCOUNTS