Page 134 - inside page.cdr

P. 134

AMINES & PLASTICIZERS LTD

NOTES FORMING PART OF THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 3 1ST MARCH 201 9

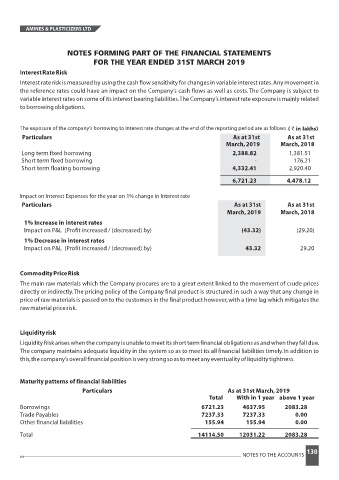

InterestRateRisk

Interest rate risk is measured by using the cash flow sensitivity for changes in variable interest rates.Any movement in

the reference rates could have an impact on the Company’s cash flows as well as costs.The Company is subject to

variable interest rates on some of its interest bearing liabilities.The Company’s interest rate exposure is mainly related

toborrowingobligations.

The exposure of the company’s borrowing to interest rate changes at the end of the reporting period are as follows ( ` in lakhs)

Particulars As at 31st As at 31st

March,201 9 March,201 8

Long term fixed borrowing 2,388.82 1,381.51

Short term fixed borrowing - 176.21

Short term floating borrowing 4,332.41 2,920.40

6,721.23 4,478.12

Impact on Interest Expenses for the year on 1% change in Interest rate

Particulars As at 31st As at 31st

March,201 9 March,201 8

1% Increase in interest rates

Impact on P&L (Profit increased / (decreased) by) (43.32 ) ( 29.20)

1% Decrease in interest rates

Impact on P&L (Profit increased / (decreased) by) 43.32 29.20

CommodityPriceRisk

The main raw materials which the Company procures are to a great extent linked to the movement of crude prices

directly or indirectly.The pricing policy of the Company final product is structured in such a way that any change in

price of raw materials is passed on to the customers in the final product however,with a time lag which mitigates the

rawmaterialpricerisk.

Liquidityrisk

LiquidityRiskariseswhenthecompanyisunabletomeetitsshorttermfinancialobligationsasandwhentheyfalldue.

The company maintains adequate liquidity in the system so as to meet its all financial liabilities timely.In addition to

this,thecompany’soverallfinancialpositionisverystrongsoastomeetanyeventualityofliquiditytightness.

Maturity patterns of financial liabilities

Particulars As at 31st March,2019

Total With in 1 year above 1 year

Borrowings 6721.23 4637.95 2083.28

Trade Payables 7237.33 7237.33 0.00

Other financial liabilities 155.94 155.94 0.00

Total 14114.50 12031.22 2083.28

130

NOTES TO THE ACCOUNTS