Page 130 - inside page.cdr

P. 130

AMINES & PLASTICIZERS LTD

NOTES FORMING PART OF THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 3 1ST MARCH 201 9

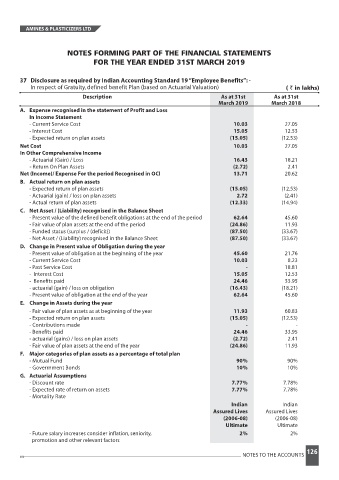

37 Disclosure as required by Indian Accounting Standard 19“Employee Benefits”: -

In respect of Gratuity,defined benefit Plan (based on Actuarial Valuation) ( ` in lakhs)

Description As at 31st As at 31st

March 2019 March 2018

A. Expense recognised in the statement of Profit and Loss

In Income Statement

- Current Service Cost 10.03 27.05

- Interest Cost 15.05 12.53

- Expected return on plan assets (15.05) (12.53)

Net Cost 10.03 27.05

In Other Comprehensive Income

- Actuarial (Gain) / Loss 16.43 18.21

- Return On Plan Assets (2.72) 2.41

Net (Income)/ Expense For the period Recognised in OCI 13.71 20.62

B. Actual return on plan assets

- Expected return of plan assets (15.05) (12.53)

- Actuarial (gain) / loss on plan assets 2.72 (2.41)

- Actual return of plan assets (12.33) (14.94)

C. Net Asset / (Liability) recognised in the Balance Sheet

- Present value of the defined benefit obligations at the end of the period 62.64 45.60

- Fair value of plan assets at the end of the period (24.86) 11.93

- Funded status (surplus / (deficit)) (87.50) (33.67)

- Net Asset / (Liability) recognised in the Balance Sheet (87.50) (33.67)

D. Change in Present value of Obligation during the year

- Present value of obligation at the beginning of the year 45.60 21.76

- Current Service Cost 10.03 8.23

- Past Service Cost - 18.81

- Interest Cost 15.05 12.53

- Benefits paid 24.46 33.95

- actuarial (gain) / loss on obligation (16.43) (18.21)

- Present value of obligation at the end of the year 62.64 45.60

E. Change in Assets during the year

- Fair value of plan assets as at beginning of the year 11.93 60.83

- Expected return on plan assets (15.05) (12.53)

- Contributions made - -

- Benefits paid 24.46 33.95

- actuarial (gains) / loss on plan assets (2.72) 2.41

- Fair value of plan assets at the end of the year (24.86) 11.93

F. Major categories of plan assets as a percentage of total plan

- Mutual Fund 90% 90%

- Goverrnment Bonds 10% 10%

G. Actuarial Assumptions

- Discount rate 7.77% 7.78%

- Expected rate of return on assets 7.77% 7.78%

- Mortality Rate

Indian Indian

Assured Lives Assured Lives

(2006-08) (2006-08)

Ultimate Ultimate

- Future salary increases consider inflation,seniority, 2% 2%

promotion and other relevant factors

126

NOTES TO THE ACCOUNTS