Page 178 - inside page.cdr

P. 178

AMINES & PLASTICIZERS LTD

NOTES FORMING PART OF THE CONSOLIDATED

FINANCIAL STATEMENTS FOR THE YEAR ENDED 31ST MARCH 2019

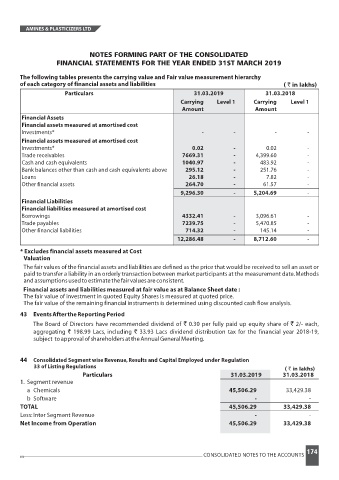

The following tables presents the carrying value and Fair value measurement hierarchy

of each category of financial assets and liabilities ( ` in lakhs)

Particulars 31.03.2019 31.03.2018

Carrying Level 1 Carrying Level 1

Amount Amount

Financial Assets

Financial assets measured at amortised cost

Investments* - - - -

Financial assets measured at amortised cost

Investments* 0.02 - 0.02 -

Trade receivables 7669.31 - 4,399.60 -

Cash and cash equivalents 1040.97 - 483.92 -

Bank balances other than cash and cash equivalents above 295.12 - 251.76 -

Loans 26.18 - 7.82 -

Other financial assets 264.70 - 61.57 -

9,296.30 - 5,204.69 -

Financial Liabilities

Financial liabilities measured at amortised cost

Borrowings 4332.41 - 3,096.61 -

Trade payables 7239.75 - 5,470.85 -

Other financial liabilitie s 714.32 - 145.14 -

12,286.48 - 8,712.60 -

* Excludes financial assets measured at Cost

Valuation

The fair values of the financial assets and liabilities are defined as the price that would be received to sell an asset or

paid to transfer a liability in an orderly transaction between market participants at the measurement date.Methods

andassumptionsusedtoestimatethefairvaluesareconsistent.

Financial assets and liabilities measured at fair value as at Balance Sheet date :

The fair value of investment in quoted Equity Shares is measured at quoted price.

The fair value of the remaining financial instruments is determined using discounted cash flow analysis.

43 EventsAftertheReportingPeriod

The Board of Directors have recommended dividend of ` 0.30 per fully paid up equity share of ` 2/- each,

aggregating ` 198.99 Lacs, including ` 33.93 Lacs dividend distribution tax for the financial year 2018-19,

subject toapprovalofshareholdersattheAnnualGeneralMeeting.

44 Consolidated Segment wise Revenue,Results and Capital Employed under Regulation

33 of Listing Regulations

( ` in lakhs)

Particulars 31.03.2019 31.03.2018

1. Segment revenue

a Chemicals 45,506.29 33,429.38

b Software - -

TOTAL 45,506.29 33,429.38

Less:Inter Segment Revenue - -

Net Income from Operation 45,506.29 33,429.38

174

CONSOLIDATED NOTES TO THE ACCOUNTS