Page 175 - inside page.cdr

P. 175

ANNUAL REPORT 2018 - 2019

NOTES FORMING PART OF THE CONSOLIDATED

FINANCIAL STATEMENTS FOR THE YEAR ENDED 31ST MARCH 2019

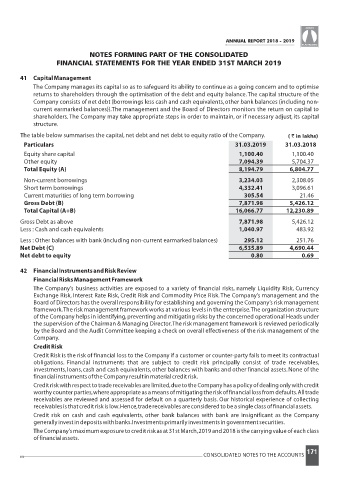

41 CapitalManagement

The Company manages its capital so as to safeguard its ability to continue as a going concern and to optimise

returns to shareholders through the optimisation of the debt and equity balance.The capital structure of the

Company consists of net debt (borrowings less cash and cash equivalents,other bank balances (including non-

current earmarked balances)).The management and the Board of Directors monitors the return on capital to

shareholders.The Company may take appropriate steps in order to maintain, or if necessary adjust, its capital

structure.

The table below summarises the capital,net debt and net debt to equity ratio of the Company. ( ` in lakhs)

Particulars 31.03.2019 31.03.2018

Equity share capital 1,100.40 1,100.40

Other equity 7,094.39 5,704.37

Total Equity (A) 8, 194.79 6,804.77

Non-current borrowings 3,234.03 2,308.05

Short term borrowings 4,332.41 3,096.61

Current maturities of long term borrowing 305.54 21.46

Gross Debt (B) 7,871.98 5,426.12

Total Capital (A+B) 16,066.77 12,230.89

Gross Debt as above 7,871.98 5,426.12

Less : Cash and cash equivalents 1,040.97 483.92

Less : Other balances with bank (including non-current earmarked balances) 295.12 251.76

Net Debt (C) 6,535.89 4,690.44

Net debt to equity 0. 80 0. 69

42 FinancialInstrumentsandRiskReview

FinancialRisksManagementFramework

The Company’s business activities are exposed to a variety of financial risks, namely Liquidity Risk, Currency

Exchange Risk, Interest Rate Risk, Credit Risk and Commodity Price Risk. The Company’s management and the

Board of Directors has the overall responsibility for establishing and governing the Company’s risk management

framework.The risk management framework works at various levels in the enterprise.The organization structure

of the Company helps in identifying,preventing and mitigating risks by the concerned operational Heads under

the supervision of the Chairman & Managing Director.The risk management framework is reviewed periodically

by the Board and the Audit Committee keeping a check on overall effectiveness of the risk management of the

Company.

CreditRisk

Credit Risk is the risk of financial loss to the Company if a customer or counter-party fails to meet its contractual

obligations. Financial instruments that are subject to credit risk principally consist of trade receivables,

investments,loans,cash and cash equivalents,other balances with banks and other financial assets.None of the

financialinstrumentsoftheCompanyresultinmaterialcreditrisk.

Creditriskwithrespecttotradereceivablesarelimited,duetotheCompanyhasapolicyofdealingonlywithcredit

worthycounterparties,whereappropriateasameansofmitigatingtheriskoffinanciallossfromdefaults.Alltrade

receivables are reviewed and assessed for default on a quarterly basis. Our historical experience of collecting

receivablesisthatcreditriskislow.Hence,tradereceivablesareconsideredtobeasingleclassoffinancialassets.

Credit risk on cash and cash equivalents, other bank balances with bank are insignificant as the Company

generallyinvestindepositswithbanks.Investmentsprimarilyinvestmentsingovernmentsecurities.

TheCompany’smaximumexposuretocreditriskasat31stMarch,2019and2018isthecarryingvalueofeachclass

offinancialassets.

171

CONSOLIDATED NOTES TO THE ACCOUNTS