Page 7 - ANTILL DGB

P. 7

Antilliaans Dagblad Maandag 1 oktober 2018 ADVERTENTIE 7

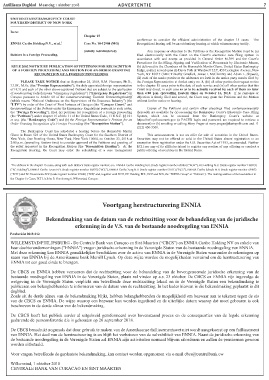

UNITED STATES BANKRUPTCY COURT

SOUTHERN DISTRICT OF NEW YORK

In re:

Chapter 15

conference to consider the efficient administration of the chapter 15 cases. The

ENNIA Caribe Holding N.V., et al., 1 Case No. 18-12908 (MG) Recognition Hearing will be an evidentiary hearing at which witnesses may testify.

(Jointly Administered) Any response or objection to the Petitions or the Recognition Motion must be (a)

Debtors in a Foreign Proceeding. filed electronically with the Court on the Court’s electronic case filing system in

accordance with and except as provided in General Order M-399 and the Court’s

Procedures for the Filing, Signing and Verification of Documents by Electronic Means,

RULE 2002 NOTICE BY PUBLICATION OF PETITIONS FOR RECOGNITION (b) delivered to the Chambers of the Honorable Martin Glenn, United States Bankruptcy

OF A FOREIGN PROCEEDING AND MOTION FOR AN ORDER GRANTING Judge, and (c) served upon (i) Davis Polk & Wardwell LLP, 450 Lexington Avenue, New

RECOGNITION OF A FOREIGN PROCEEDING York, NY 10017 (Attn: Timothy Graulich, James I. McClammy and Adam L. Shpeen),

(ii) each of the notice parties at the addresses set forth in the notice party matrix filed by

PLEASE TAKE NOTICE that on September 25, 2018, R.M. Hermans, Ph.D., the Foreign Representative at docket entry no. 8, (iii) all other parties that request notice

LL.M., M.Sc. (the “Foreign Representative”), the duly appointed foreign representative in the chapter 15 cases prior to the date of such service and (iv) all other parties that this

of ECH and each of the other above-captioned Debtors that are subject to the application Court may direct, in each case so as to be actually received by each of them no later

of noodregeling (which means “emergency regulations”) (“Emergency Regulations”) in than 4:00 p.m. (prevailing Eastern time) on October 16, 2018. If no response or

Curaçao pursuant to Article 60 of the Landsverordening Toezicht Verzekeringsbedrijf objection is timely filed and served, the Court may grant the Petitions and the Motion

(which means “National Ordinance on the Supervision of the Insurance Industry”) (the without further notice or hearing.

“LTV”) by order of the Court of First Instance of Curaçao (the “Curaçao Court,” and

the proceedings of the Debtors under the Emergency Regulations pursuant to such order, Copies of the Petitions and certain other pleadings filed contemporaneously

the “Foreign Proceeding”), filed (a) petitions for recognition of a foreign proceeding therewith are available by (a) accessing the Bankruptcy Court’s Electronic Case Filing

(the “Petitions”) under chapter 15 of title 11 of the United States Code, 11 U.S.C. §§ 101 System, which can be accessed from the Bankruptcy Court’s website at

et seq. (the “Bankruptcy Code”) and (b) the Foreign Representative’s Petition for an https://ecf.nysb.uscourts.gov (a PACER login and password are required to retrieve a

Order Granting Recognition of a Foreign Proceeding (the “Recognition Motion”). document) or (b) emailing or calling Mary Prager at mary.prager@davispolk.com and +1

(212) 450-3509.

The Bankruptcy Court has scheduled a hearing before the Honorable Martin

Glenn in Room 523 of the United States Bankruptcy Court for the Southern District of This announcement is not an offer for sale of securities in the United States.

New York, One Bowling Green, New York, New York 10004, on October 23, 2018 at Securities may not be offered or sold in the United States absent registration or an

2:00 p.m. (prevailing Eastern time) to consider approval of the Petitions and granting of exemption from registration under the U.S. Securities Act of 1933, as amended. Neither

the relief requested in the Recognition Motion (the “Recognition Hearing”). At the ECH nor any of its affiliates intend to register any portion of any offering or conduct a

Recognition Hearing, the Court may order the scheduling of a case management public offering of securities in the United States.

1 Th e debtors in the chapter 15 cases, along with each debtor’s trade register number, are: ENNIA Caribe Holding N.V. (trade register number 63986) (“ECH”), EC Holding N.V. (trade register number 138313)

(“EC Holding”), ENNIA Caribe Leven N.V. (trade register number 36875) (“ECL”), ENNIA Caribe Zorg N.V. (trade register number 51811) (“ECZ”), ENNIA Caribe Schade N.V. (trade register number 63987)

(“ECS”) and EC Investments B.V. (trade register number 99988) (“ECI,” and, together with ECH, EC Holding, ECL, ECZ and ECS, the “ENNIA Group” or “Debtors”). Th e mailing address of the lead debtor in

the Chapter 15 Cases, ECH, is John B. Gorsiraweg 6, Willemstad, Curaçao.

Voortgang herstructurering ENNIA

Bekendmaking van de datum van de rechtszitting voor de behandeling van de juridische

erkenning in de V.S. van de bestaande noodregeling van ENNIA

Persbericht 2018-042

WILLEMSTAD/PHILIPSBURG - De Centrale Bank van Curaçao en Sint Maarten (“CBCS”) en ENNIA Caribe Holding NV en enkele van

haar dochterondernemingen (“ENNIA”) vragen juridische erkenning in de Verenigde Staten van de bestaande noodregeling van ENNIA.

Met deze erkenning kan ENNIA gemakkelijker beschikken over de activa van ENNIA in de Verenigde Staten waaronder de rekeningen op

naam van ENNIA bij de Amerikaanse bank Merrill Lynch. Op deze wijze worden de mogelijkheden verruimd om de herstructurering van

ENNIA tot een goed einde te brengen.

De CBCS en ENNIA hebben vernomen dat de rechtszitting voor de behandeling van de bovengenoemde juridische erkenning van de

bestaande noodregeling van ENNIA in de Verenigde Staten, plaats zal vinden op a.s. 23 oktober. De CBCS en ENNIA zijn ingevolge de

wetgeving in de Verenigde Staten verplicht om betreffende deze rechtszitting lokaal en in de Verenigde Staten een bekendmaking te

publiceren om belanghebbenden te informeren van de datum van de rechtszitting. In het kader hiervan is die bekendmaking geplaatst in dit

dagblad.

Zoals uit de derde alinea van de bekendmaking blijkt, hebben belanghebbenden de mogelijkheid om bezwaar aan te tekenen tegen de eis

van de CBCS en ENNIA. De wijze waarop een bezwaar kan worden ingediend en de uiterlijke datum waarop dat moet gebeuren is ook

beschreven in de derde alinea van de bekendmaking.

De CBCS heeft het publiek eerder al uitgebreid geïnformeerd over bovenstaand proces en de consequenties van de legale erkenning

gedurende de persconferentie die is gehouden op 26 september 2018.

De CBCS benadrukt nogmaals dat door gebruik te maken van de Amerikaanse faillissementswet niet wordt aangekoerst op een faillissement

van ENNIA. Het doel van de herstructurering is en blijft het verbeteren van de solvabiliteit van ENNIA. Naast de juridische erkenning van

de bestaande noodregeling in de Verenigde Staten zal ENNIA zijn activiteiten normaal blijven uitoefenen en zullen de pensioenen gewoon

worden uitbetaald.

Voor vragen betreffende de geplaatste bekendmaking, kan contact worden opgenomen via e-mail cbcs@centralbank.cw

Willemstad, 1 oktober 2018

CENTRALE BANK VAN CURACAO EN SINT MAARTEN