Page 747 - Insurance Statistics 2021

P. 747

Indian Non-life Insurance Industry

Yearbook 2018-19

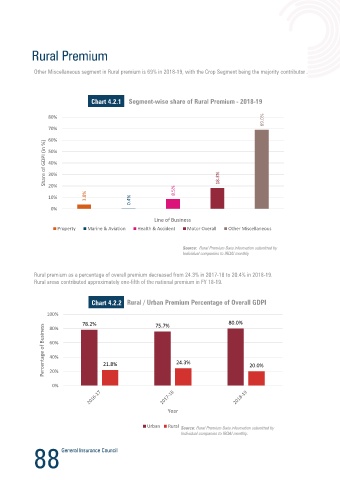

Other Miscellaneous segment in Rural premium is 69% in 2018-19, with the Crop Segment being the majority contributor .

The Motor OD premium has grown at a CAGR of 12.1% over the period 2009-10 to 2018-19.

Chart 4.2.1 Segment-wise share of Rural Premium - 2018-19

Table 4.3.1 Motor OD

69.0%

80%

70% 2018-19 Value

8,28,79,322

No. Of Policies

60%

Share of GDPI (in %) 50% 18.3% No. Of Claims Reported 79,41,510

26,487

Premium (in Cr)

40%

No. Of Paid Claims

74,68,521

30%

18,849

20%

3.8% 8.5% Amt of Paid Claims(in Cr) Premium booked in India considered

10% 0.4%

0%

Chart 4.3.1

Line of Business

Property Marine & Aviation Health & Accident Motor Overall Other Miscellaneous

30,000 27,745 28,092

25,140

24,000 22,714

20,730

19,572

18,090

₹ in Crores

Rural premium as a percentage of overall premium decreased from 24.3% in 2017-18 to 20.4% in 2018-19. 18,000 15,295

Rural areas contributed approximately one-fifth of the national premium in FY 18-19. 12,000 10,013 12,408

Chart 4.2.2 Rural / Urban Premium Percentage of Overall GDPI

6,000

100% 78.2% 75.7% 80.0% -

Percentage of Business 60% 21.8% 24.3% 20.0% Year

80%

40%

20%

data submitted by companies

0% Source: Council Compilation as per source

The Gross Incurred Claims Ratio for Motor Own damage segment has been in the range of 53% – 73% over the period

2009-10 to 2018-19. Gross Incurred Claims increased by approximately 9% as compared to 2017-18, largely driven by

multiple flooding events in Urban areas in the last year.

Year

Urban Rural

88 89