Page 39 - Banking Finance November 2021

P. 39

ARTICLE

to HFCs which do not currently fulfill the qualifying assets (HFC) and companies proposing to seek registration

criteria, but wish to continue as HFCs in future. The under NHB Act. The existing HFCs would be provided

timeline shall be phased as under: with a glide path to achieve minimum Net Owned Fund

(NOF) of Rs 20 crore. They will be required to reach Rs

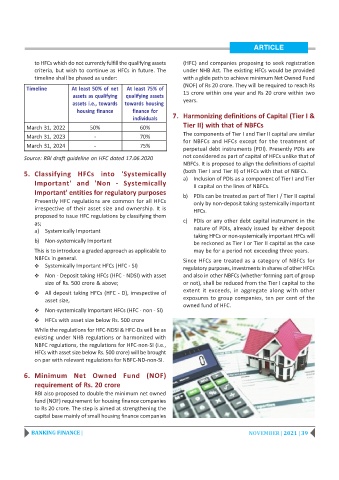

Timeline At least 50% of net At least 75% of

assets as qualifying qualifying assets 15 crore within one year and Rs 20 crore within two

assets i.e., towards towards housing years.

housing finance finance for

individuals 7. Harmonizing definitions of Capital (Tier I &

March 31, 2022 50% 60% Tier II) with that of NBFCs

The components of Tier I and Tier II capital are similar

March 31, 2023 - 70%

for NBFCs and HFCs except for the treatment of

March 31, 2024 - 75%

perpetual debt instruments (PDI). Presently PDIs are

Source: RBI draft guideline on HFC dated 17.06.2020 not considered as part of capital of HFCs unlike that of

NBFCs. It is proposed to align the definitions of capital

5. Classifying HFCs into 'Systemically (both Tier I and Tier II) of HFCs with that of NBFCs.

a) Inclusion of PDIs as a component of Tier I and Tier

Important' and 'Non - Systemically

II capital on the lines of NBFCs.

Important' entities for regulatory purposes

b) PDIs can be treated as part of Tier I / Tier II capital

Presently HFC regulations are common for all HFCs only by non-deposit taking systemically important

irrespective of their asset size and ownership. It is HFCs.

proposed to issue HFC regulations by classifying them

as; c) PDIs or any other debt capital instrument in the

a) Systemically Important nature of PDIs, already issued by either deposit

taking HFCs or non-systemically important HFCs will

b) Non-systemically Important be reckoned as Tier I or Tier II capital as the case

This is to introduce a graded approach as applicable to may be for a period not exceeding three years.

NBFCs in general. Since HFCs are treated as a category of NBFCs for

Y Systemically Important HFCs (HFC - SI)

regulatory purposes, investments in shares of other HFCs

Y Non - Deposit taking HFCs (HFC - NDSI) with asset and also in other NBFCs (whether forming part of group

size of Rs. 500 crore & above; or not), shall be reduced from the Tier I capital to the

Y All deposit taking HFCs (HFC - D), irrespective of extent it exceeds, in aggregate along with other

asset size, exposures to group companies, ten per cent of the

owned fund of HFC.

Y Non-systemically Important HFCs (HFC - non - SI)

Y HFCs with asset size below Rs. 500 crore

While the regulations for HFC-NDSI & HFC-Ds will be as

existing under NHB regulations or harmonized with

NBFC regulations, the regulations for HFC-non-SI (i.e.,

HFCs with asset size below Rs. 500 crore) will be brought

on par with relevant regulations for NBFC-ND-non-SI.

6. Minimum Net Owned Fund (NOF)

requirement of Rs. 20 crore

RBI also proposed to double the minimum net owned

fund (NOF) requirement for housing finance companies

to Rs 20 crore. The step is aimed at strengthening the

capital base mainly of small housing finance companies

BANKING FINANCE | NOVEMBER | 2021 | 39