Page 11 - Food Outlook

P. 11

CASSAVA

After two decades of uninterrupted growth, world cassava production is forecast to undergo a slight contraction

in 2017. A combination of policy changes, depressed

root prices and adverse weather in the major producing countries is thought to have been responsible for lowering plantings in 2017 resulting in a decline in production.

The volume of world trade in cassava in 2017

is expected to remain stable, matching the positive outcomes of the two preceding years. International flows of cassava, primarily confined to East and Southeast

Asia, are very much contingent on industrial and feed demand, particularly from China, the world’s leading cassava importer, and on the competitiveness of supplies

in Thailand, the world’s leading exporter. However, a downturn in China’s maize supply prospects, the domestic substitute for imported cassava, has paved the way for sustained cassava deliveries to the country. The revival in cassava demand has given support to international product quotations, which had fallen to multi-year lows in the past 12 months.

The current positive trade prospects may only provide

a temporary stimulus to cassava sectors in the region. A bumper maize crop in China in the following season would pose a significant threat to cassava demand as would a more active policy of de-stocking maize in the country.

The potential for cassava to compete in markets beyond China is also uncertain, given that international maize prices are currently hovering at relatively very low levels. While cassava root prices in Southeast Asia have firmed

in recent months, the outlook for next year and beyond will much depend on whether producers would be willing to accept the risks of a possible strong decline in cassava demand in China. Already some indication is provided by way of a recent official survey in Thailand, which points to 9 percent drop in cassava area in 2018.

Contact:

Adam.Prakash@fao.org

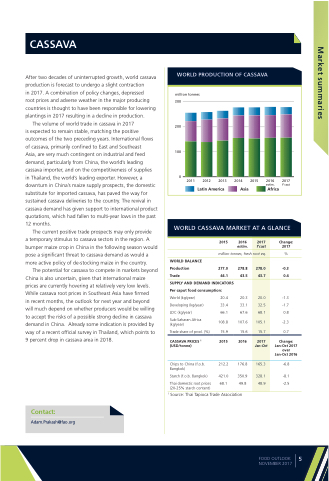

WORLD PRODUCTION OF CASSAVA

million tonnes 300

200

100

0

2011 2012 2013

Latin America

2014 2015

Asia

2016 2017 estim. f’cast

Africa

WORLD CASSAVA MARKET AT A GLANCE

2017

f’cast

root eq.

278.0 43.7

20.0 32.5 68.1

105.1 15.7

2017

Jan-Oct

165.3

328.1 48.9

WORLD BALANCE Production

Trade

2015 2016

estim.

million tonnes, fresh

277.0 278.8 44.1 43.5

Change: 2017

%

-0.3 0.4

-1.3 -1.7 0.8

-2.3 0.7

Change: Jan-Oct 2017 over Jan-Oct 2016

-6.8

-8.1 -2.5

SUPPLY AND DEMAND INDICATORS Per caput food consumption:

World (kg/year)

Developing (kg/year)

LDC (kg/year)

Sub-Saharan Africa (kg/year)

Trade share of prod. (%)

CASSAVA PRICES 1 (USD/tonne)

Chips to China (f.o.b. Bangkok)

Starch (f.o.b. Bangkok)

Thai domestic root prices (20-25% starch content)

20.4 20.3 33.4 33.1 66.1 67.6

108.8 107.6 15.9 15.6

2015 2016

212.2 176.8

421.0 350.9 68.1 49.8

1 Source: Thai Tapioca Trade Association

FOOD OUTLOOK NOVEMBER 2017

5

Market summaries