Page 12 - Food Outlook

P. 12

OILCROPS

The 2016/17 season saw an easing in the global oilseeds and oilmeal supply and demand situation, while vegetable oil fundamentals remained relatively tight. Accordingly, during the recently ended October/September marketing year, international prices for oilseeds and oilmeals remained subdued, while those of oils/fats maintained their strength.

Preliminary forecasts for 2017/18 point to a broadly balanced global supply and demand situation, in both the oilseed and meal markets as well as in the oils/fats segment. Global oilseed production is forecast to match last season’s record level, with small year-on-year contractions in soybean and sunflowerseed compensated by improvements in other oilcrops. While the global area of the seven major oilseeds

is anticipated to expand further, average yields are expected to retreat to trend levels, following last season’s unparalleled highs. For soybeans, individual countries’ prospects are mixed, with year-on-year gains concentrated in the Northern Hemisphere, notably the United States, China and Canada, while, in South America, possible drops are looming in Brazil and Argentina.

World oils/fats production is forecast to expand moderately in 2017/18. Growth would be led by palm oil, with production in Southeast Asia reverting to average growth, after the last two seasons’ El Niño-related swings. Global oils/fats utilization could grow less than last season, assuming moderate income growth in a number of countries and only limited expansion

in demand from the biodiesel sector. International meal output, on the other hand, is forecast to remain flat, given

the anticipated drop in soybean production. Based on current forecasts, global supplies of both meals and oils/fats would

be adequate to meet global demand, thus allowing end-of- season stocks to remain at comfortable levels. World trade in oils/fats and meals/cakes is anticipated to keep expanding in 2017/18, albeit at a somewhat reduced pace compared with the previous season.

In the coming months, international prices of oilseeds, oils and meals will be influenced by changes in the production forecasts for soybeans in South America and palm oil in Southeast Asia. Uncertainties remain regarding the actual course of global oil and meal demand, including, in the case of oils/fats, the impact of recent policy changes concerning the biodiesel market.

Contact:

Peter.Thoenes@fao.org

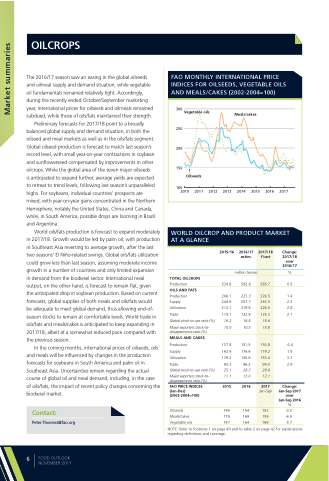

FAO MONTHLY INTERNATIONAL PRICE INDICES FOR OILSEEDS, VEGETABLE OILS AND MEALS/CAKES (2002-2004=100)

300 Vegetable oils 250

200

150

Oilseeds

100

Meals/cakes

2010 2011 2012

2013 2014 2015

2016 2017

WORLD OILCROP AND PRODUCT MARKET AT A GLANCE

2017/18

f’cast

s

585.7

226.5 263.5 226.0 125.3

16.6 10.8

150.8 179.2 150.4

99.0

28.6 12.1

2017

Jan-Sep

153 159 169

2015/16 2016/17

Change: 2017/18 over 2016/17

%

0.5

1.4 2.2 2.8 2.1

-0.4 1.5 3.3 2.9

Change: Jan-Sep 2017 over Jan-Sep 2016 %

-0.2 -6.9 5.7

TOTAL OILCROPS

Production

OILS AND FATS

Production

Supply

Utilization

Trade

Global stock-to-use ratio (%)

Major exporters stock-to- disappearance ratio (%)

MEALS AND CAKES

Production

Supply

Utilization

Trade 90.3

estim.

million tonne

582.6

223.3 257.7 219.8 122.8

534.8

206.1 244.9 212.1 115.1

Global stock-to-use ratio (%)

Major exporters stock-to- disappearance ratio (%)

FAO PRICE INDICES (Jan-Dec) (2002-2004=100)

Oilseeds Meals/cakes Vegetable oils

25.1 28.3 11.1 13.0

2015 2016

149 154 179 169 147 164

16.2 16.8 10.0 10.5

137.8 163.9 139.2

151.5 176.6 145.6

96.2

NOTE: Refer to footnote 1 on page 40 and to table 2 on page 42 for explanations regarding definitions and coverage.

6

FOOD OUTLOOK NOVEMBER 2017

Market summaries