Page 50 - Strategic Tax Planning for Global Commerce & Investment

P. 50

Tax Benefits for U.S. Exporters

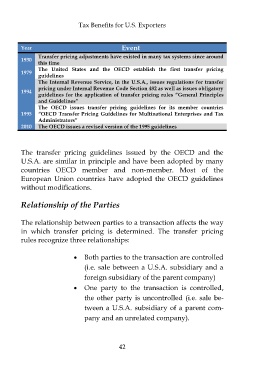

Year Event

Transfer pricing adjustments have existed in many tax systems since around

1930

this time

The United States and the OECD establish the first transfer pricing

1979

guidelines

The Internal Revenue Service, in the U.S.A., issues regulations for transfer

pricing under Internal Revenue Code Section 482 as well as issues obligatory

1994

guidelines for the application of transfer pricing rules “General Principles

and Guidelines”

The OECD issues transfer pricing guidelines for its member countries

1995 “OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax

Administrators”

2010 The OECD issues a revised version of the 1995 guidelines

The transfer pricing guidelines issued by the OECD and the

U.S.A. are similar in principle and have been adopted by many

countries OECD member and non-member. Most of the

European Union countries have adopted the OECD guidelines

without modifications.

Relationship of the Parties

The relationship between parties to a transaction affects the way

in which transfer pricing is determined. The transfer pricing

rules recognize three relationships:

Both parties to the transaction are controlled

(i.e. sale between a U.S.A. subsidiary and a

foreign subsidiary of the parent company)

One party to the transaction is controlled,

the other party is uncontrolled (i.e. sale be-

tween a U.S.A. subsidiary of a parent com-

pany and an unrelated company).

42