Page 51 - Fleet

P. 51

Version 2 – updated 27.10.2022

HOW TO CLAIM BUSINESS MILEAGE AT HSS HIRE

The purpose of this guide is to provide guidance to colleagues on how to claim business mileage, complying with

both the HMRC rules and HSS policies.

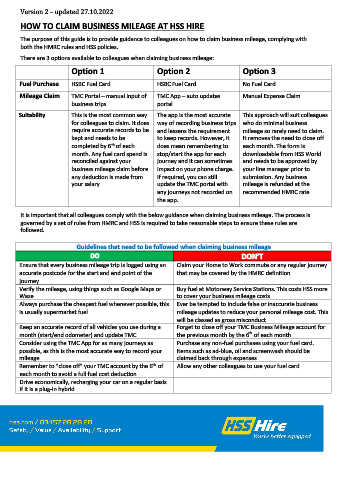

There are 3 options available to colleagues when claiming business mileage:

Option 1 Option 2 Option 3

Fuel Purchase HSBC Fuel Card HSBC Fuel Card No Fuel Card

Mileage Claim TMC Portal – manual input of TMC App – auto updates Manual Expense Claim

business trips portal

Suitability This is the most common way The app is the most accurate This approach will suit colleagues

for colleagues to claim. It does way of recording business trips who do minimal business

require accurate records to be and lessens the requirement mileage so rarely need to claim.

kept and needs to be to keep records. However, it It removes the need to close off

th

completed by 6 of each does mean remembering to each month. The form is

month. Any fuel card spend is stop/start the app for each downloadable from HSS World

reconciled against your journey and it can sometimes and needs to be approved by

business mileage claim before impact on your phone charge. your line manager prior to

any deduction is made from If required, you can still submission. Any business

your salary update the TMC portal with mileage is refunded at the

any journeys not recorded on recommended HMRC rate

the app.

It is important that all colleagues comply with the below guidance when claiming business mileage. The process is

governed by a set of rules from HMRC and HSS is required to take reasonable steps to ensure these rules are

followed.

Guidelines that need to be followed when claiming business mileage

DO DON’T

Ensure that every business mileage trip is logged using an Claim your Home to Work commute or any regular journey

accurate postcode for the start and end point of the that may be covered by the HMRC definition

journey

Verify the mileage, using things such as Google Maps or Buy fuel at Motorway Service Stations. This costs HSS more

Waze to cover your business mileage costs

Always purchase the cheapest fuel whenever possible, this Ever be tempted to include false or inaccurate business

is usually supermarket fuel mileage updates to reduce your personal mileage cost. This

will be classed as gross misconduct

Keep an accurate record of all vehicles you use during a Forget to close off your TMC Business Mileage account for

th

month (start/end odometer) and update TMC the previous month by the 6 of each month

Consider using the TMC App for as many journeys as Purchase any non-fuel purchases using your fuel card.

possible, as this is the most accurate way to record your Items such as ad-blue, oil and screenwash should be

mileage claimed back through expenses

th

Remember to “close off” your TMC account by the 6 of Allow any other colleagues to use your fuel card

each month to avoid a full fuel cost deduction

Drive economically, recharging your car on a regular basis

if it is a plug-in hybrid