Page 89 - Demo

P. 89

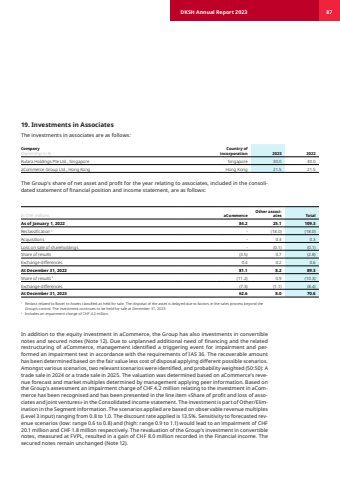

19. Investments in AssociatesThe investments in associates are as follows:Company Ownership in %Country of incorporation 2023 2022Kulara Holdings Pte Ltd., Singapore Singapore 30.0 30.0 aCommerce Group Ltd., Hong Kong Hong Kong 21.5 21.5 The Group%u2019s share of net asset and profit for the year relating to associates, included in the consolidated statement of financial position and income statement, are as follows:in CHF millions aCommerceOther associates Total As of January 1, 2022 84.2 25.1 109.3 Reclassification 1 - (18.0) (18.0) Acquisitions - 0.3 0.3 Loss on sale of shareholdings - (0.1) (0.1) Share of results (3.5) 0.7 (2.8) Exchange differences 0.4 0.2 0.6 At December 31, 2022 81.1 8.2 89.3 Share of results 2 (11.2) 0.9 (10.3) Exchange differences (7.3) (1.1) (8.4) At December 31, 2023 62.6 8.0 70.6 1 Reclass related to Bovet to Assets classified as held for sale. The disposal of the asset is delayed due to factors in the sales process beyond the Group%u2019s control. The investment continues to be held for sale at December 31, 2023.2 Includes an impairment charge of CHF 4.2 million.In addition to the equity investment in aCommerce, the Group has also investments in convertible notes and secured notes (Note 12). Due to unplanned additional need of financing and the related restructuring of aCommerce, management identified a triggering event for impairment and performed an impairment test in accordance with the requirements of IAS 36. The recoverable amount has been determined based on the fair value less cost of disposal applying different possible scenarios. Amongst various scenarios, two relevant scenarios were identified, and probability weighted (50:50): A trade sale in 2024 or a trade sale in 2025. The valuation was determined based on aCommerce%u2019s revenue forecast and market multiples determined by management applying peer information. Based on the Group%u2019s assessment an impairment charge of CHF 4.2 million relating to the investment in aCommerce has been recognised and has been presented in the line item %u00abShare of profit and loss of associates and joint ventures%u00bb in the Consolidated income statement. The investment is part of Other/Elim,ination in the Segment information. The scenarios applied are based on observable revenue multiples (Level 3 input) ranging from 0.8 to 1.0. The discount rate applied is 13.5%. Sensitivity to forecasted revenue scenarios (lo range 0.6 to 0.8) and (high: range 0.9 to 1.1) would lead to an impairment of CHF 20.1 million and CHF 1.8 million respectively. The revaluation of the Group%u2019s investment in convertible notes, measured at FVPL, resulted in a gain of CHF 8.0 million recorded in the Financial income. The secured notes remain unchanged (Note 12).DKSH Annual Report 2023 87