Page 91 - Demo

P. 91

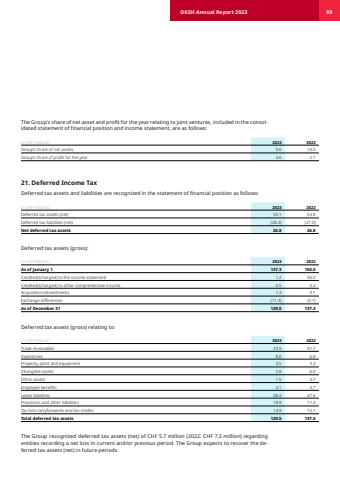

The Group%u2019s share of net asset and profit for the year relating to joint ventures, included in the consolidated statement of financial position and income statement, are as follows:in CHF millions 2023 2022Group%u2019s share of net assets 9.6 10.0 Group%u2019s share of profit for the year 4.6 2.7 21. Deferred Income TaxDeferred tax assets and liabilities are recognized in the statement of financial position as follows:in CHF millions 2023 2022Deferred tax assets (net) 55.1 53.8 Deferred tax liabilities (net) (28.3) (27.0) Net deferred tax assets 26.8 26.8 Deferred tax assets (gross):in CHF millions 2023 2022As of January 1 137.3 104.0 Credited/(charged) to the income statement 1.2 36.0 Credited/(charged) to other comprehensive income 0.5 0.3 Acquisitions/divestments 1.3 0.1 Exchange differences (11.3) (3.1) As of December 31 129.0 137.3 Deferred tax assets (gross) relating to:in CHF millions 2023 2022Trade receivables 33.9 31.7 Inventories 8.0 6.8 Property, plant and equipment 3.5 3.3 Intangible assets 5.8 6.0 Other assets 1.5 4.7 Employee benefits 4.1 4.7 Lease liabilities 38.4 47.6 Provisions and other liabilities 18.9 17.4 Tax loss carryforwards and tax credits 14.9 15.1 Total deferred tax assets 129.0 137.3 The Group recognized deferred tax assets (net) of CHF 5.7 million (2022: CHF 7.3 million) regarding entities recording a net loss in current and/or previous period. The Group expects to recover the deferred tax assets (net) in future periods.DKSH Annual Report 2023 89