Page 92 - Demo

P. 92

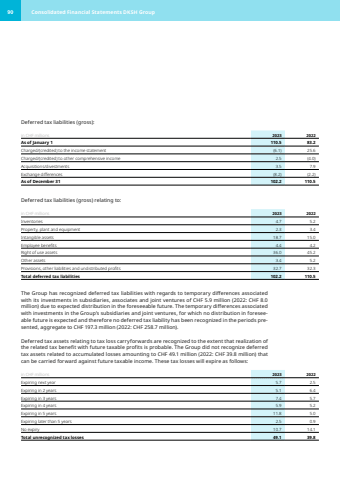

Deferred tax liabilities (gross):in CHF millions 2023 2022As of January 1 110.5 83.2 Charged/(credited) to the income statement (6.1) 25.6 Charged/(credited) to other comprehensive income 2.5 (4.0) Acquisitions/divestments 3.5 7.9 Exchange differences (8.2) (2.2) As of December 31 102.2 110.5 Deferred tax liabilities (gross) relating to:in CHF millions 2023 2022Inventories 4.7 5.2 Property, plant and equipment 2.3 3.4 Intangible assets 18.7 15.0 Employee benefits 4.4 4.2 Right of use assets 36.0 45.2 Other assets 3.4 5.2 Provisions, other liabilities and undistributed profits 32.7 32.3 Total deferred tax liabilities 102.2 110.5 The Group has recognized deferred tax liabilities with regards to temporary differences associated with its investments in subsidiaries, associates and joint ventures of CHF 5.9 million (2022: CHF 8.0 million) due to expected distribution in the foreseeable future. The temporary differences associated with investments in the Group%u2019s subsidiaries and joint ventures, for which no distribution in foresee,able future is expected and therefore no deferred tax liability has been recognized in the periods presented, aggregate to CHF 197.3 million (2022: CHF 258.7 million).Deferred tax assets relating to tax loss carryforwards are recognized to the extent that realization of the related tax benefit with future taxable profits is probable. The Group did not recognize deferred tax assets related to accumulated losses amounting to CHF 49.1 million (2022: CHF 39.8 million) that can be carried forward against future taxable income. These tax losses will expire as follows:in CHF millions 2023 2022Expiring next year 5.7 2.5 Expiring in 2 years 5.1 6.4 Expiring in 3 years 7.4 5.7 Expiring in 4 years 5.9 5.2 Expiring in 5 years 11.8 5.0 Expiring later than 5 years 2.5 0.9 No expiry 10.7 14.1 Total unrecognized tax losses 49.1 39.8 90 Consolidated Financial Statements DKSH Group