Page 88 - Demo

P. 88

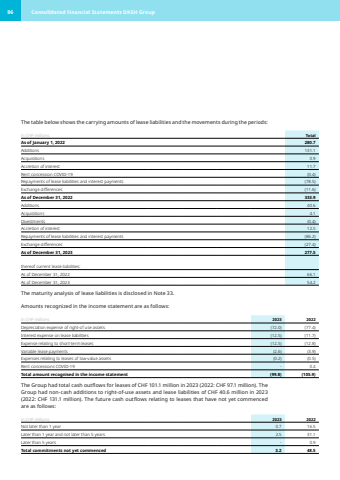

The table below shows the carrying amounts of lease liabilities and the movements during the periods:in CHF millions Total As of January 1, 2022 280.7 Additions 131.1 Acquisitions 0.9 Accretion of interest 11.7 Rent concession COVID-19 (0.4) Repayments of lease liabilities and interest payments (78.5) Exchange differences (11.6) As of December 31, 2022 333.9 Additions 40.6 Acquisitions 4.1 Divestments (0.4) Accretion of interest 12.5 Repayments of lease liabilities and interest payments (86.2) Exchange differences (27.4) As of December 31, 2023 277.5 thereof current lease liabilities:As of December 31, 2022 66.1 As of December 31, 2023 54.2 The maturity analysis of lease liabilities is disclosed in Note 33.Amounts recognized in the income statement are as follows:in CHF millions 2023 2022Depreciation expense of right-of use assets (72.0) (77.4) Interest expense on lease liabilities (12.5) (11.7) Expense relating to short-term leases (12.5) (12.8) Variable lease payments (2.6) (3.9) Expenses relating to leases of low-value assets (0.2) (0.5) Rent concessions COVID-19 - 0.4 Total amount recognised in the income statement (99.8) (105.9) The Group had total cash outflows for leases of CHF 101.1 million in 2023 (2022: CHF 97.1 million). The Group had non-cash additions to right-of-use assets and lease liabilities of CHF 40.6 million in 2023 (2022: CHF 131.1 million). The future cash outflows relating to leases that have not yet commenced are as follows:in CHF millions 2023 2022Not later than 1 year 0.7 16.5 Later than 1 year and not later than 5 years 2.5 31.1 Later than 5 years - 0.9 Total commitments not yet commenced 3.2 48.5 86 Consolidated Financial Statements DKSH Group