Page 37 - 2022 AEO Benefit Guide

P. 37

Spousal Life Insurance REMINDER

You may purchase spousal life insurance in the amount of $10,000, $20,000, or $40,000.

Spousal life insurance rates are $0.83, $1.66, and $3.32 per pay, respectively. Please be sure to desig-

nate two loved ones as your

Dependent Life Insurance beneficiaries on the AEO

Benefitfocus portal.

You may purchase dependent life insurance in the amount of $10,000 per unmar-

ried dependent up to age 26. Unmarried dependents must reside with you, unless

currently a full time student. The cost of this coverage is $0.83 per pay, regardless of

the number of dependents you have enrolled.

Voluntary AD&D

You may purchase additional AD&D insurance in the amounts of 1x, 2x or 3x your

annual base salary (rounded up to the nearest thousand), to a maximum of $500,000.

The cost of this coverage varies based on your salary and age. You can find your

customized rate on the AEO Benefitfocus portal.

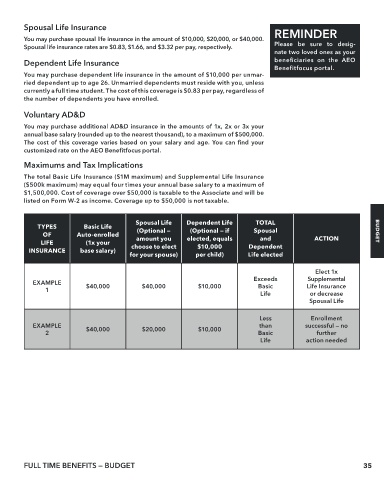

Maximums and Tax Implications

The total Basic Life Insurance ($1M maximum) and Supplemental Life Insurance

($500k maximum) may equal four times your annual base salary to a maximum of

$1,500,000. Cost of coverage over $50,000 is taxable to the Associate and will be

listed on Form W-2 as income. Coverage up to $50,000 is not taxable.

Spousal Life Dependent Life TOTAL

TYPES Basic Life (Optional — (Optional — if Spousal

OF Auto-enrolled BUDGET

LIFE (1x your amount you elected, equals and ACTION

INSURANCE base salary) choose to elect $10,000 Dependent

for your spouse) per child) Life elected

Elect 1x

Exceeds Supplemental

EXAMPLE

1 $40,000 $40,000 $10,000 Basic Life Insurance

Life or decrease

Spousal Life

Less Enrollment

EXAMPLE $40,000 $20,000 $10,000 than successful — no

2 Basic further

Life action needed

FULL TIME BENEFITS — BUDGET 35