Page 10 - 2022 New Relic Guide

P. 10

Your Health

Summary of Your Your Health Pre-Tax Spending Life/AD&D Where to Find

How to Get Started Dental & Vision 401(k) Additional Benefits

Contributions BenefitsBenefits Accounts Disability Support

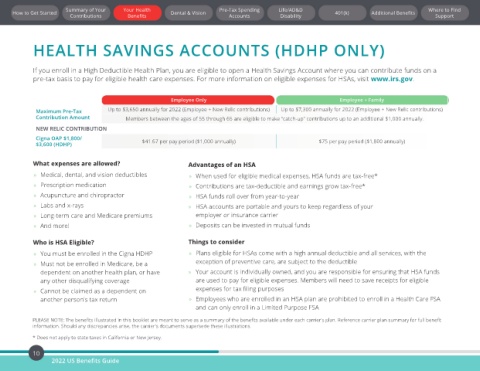

HEALTH SAVINGS ACCOUNTS (HDHP ONLY)

If you enroll in a High Deductible Health Plan, you are eligible to open a Health Savings Account where you can contribute funds on a

pre-tax basis to pay for eligible health care expenses. For more information on eligible expenses for HSAs, visit www.irs.gov.

Employee Only Employee + Family

Maximum Pre-Tax Up to $3,650 annually for 2022 (Employee + New Relic contributions) Up to $7,300 annually for 2022 (Employee + New Relic contributions)

Contribution Amount Members between the ages of 55 through 65 are eligible to make “catch-up” contributions up to an additional $1,000 annually.

NEW RELIC CONTRIBUTION

Cigna OAP $1,800/ $41.67 per pay period ($1,000 annually) $75 per pay period ($1,800 annually)

$3,600 (HDHP)

What expenses are allowed? Advantages of an HSA

» Medical, dental, and vision deductibles » When used for eligible medical expenses, HSA funds are tax-free*

» Prescription medication » Contributions are tax-deductible and earnings grow tax-free*

» Acupuncture and chiropractor » HSA funds roll over from year-to-year

» Labs and x-rays » HSA accounts are portable and yours to keep regardless of your

» Long-term care and Medicare premiums employer or insurance carrier

» And more! » Deposits can be invested in mutual funds

Who is HSA Eligible? Things to consider

» You must be enrolled in the Cigna HDHP » Plans eligible for HSAs come with a high annual deductible and all services, with the

» Must not be enrolled in Medicare, be a exception of preventive care, are subject to the deductible

dependent on another health plan, or have » Your account is individually owned, and you are responsible for ensuring that HSA funds

any other disqualifying coverage are used to pay for eligible expenses. Members will need to save receipts for eligible

» Cannot be claimed as a dependent on expenses for tax filing purposes

another person's tax return » Employees who are enrolled in an HSA plan are prohibited to enroll in a Health Care FSA

and can only enroll in a Limited Purpose FSA

PLEASE NOTE: The benefits illustrated in this booklet are meant to serve as a summary of the benefits available under each carrier's plan. Reference carrier plan summary for full benefit

information. Should any discrepancies arise, the carrier's documents supersede these illustrations.

* Does not apply to state taxes in California or New Jersey.

10

2022 US Benefits Guide